- Pronouns

- He/Him

- Thread starter

- #1

https://www.hd.square-enix.com/eng/ir/pdf/23q3release.pdf

Sources

Financial Results - https://www.hd.square-enix.com/eng/ir/pdf/23q3earnings.pdf

Financial Results Presentation - https://www.hd.square-enix.com/eng/ir/pdf/23q3slides.pdf

Previous threads

FY3/2023

Q1 - https://www.installbaseforum.com/fo...3-2023-april-june-2022-financial-results.974/

Q2 - https://www.installbaseforum.com/fo...-6-month-period-ended-september-30-2022.1186/

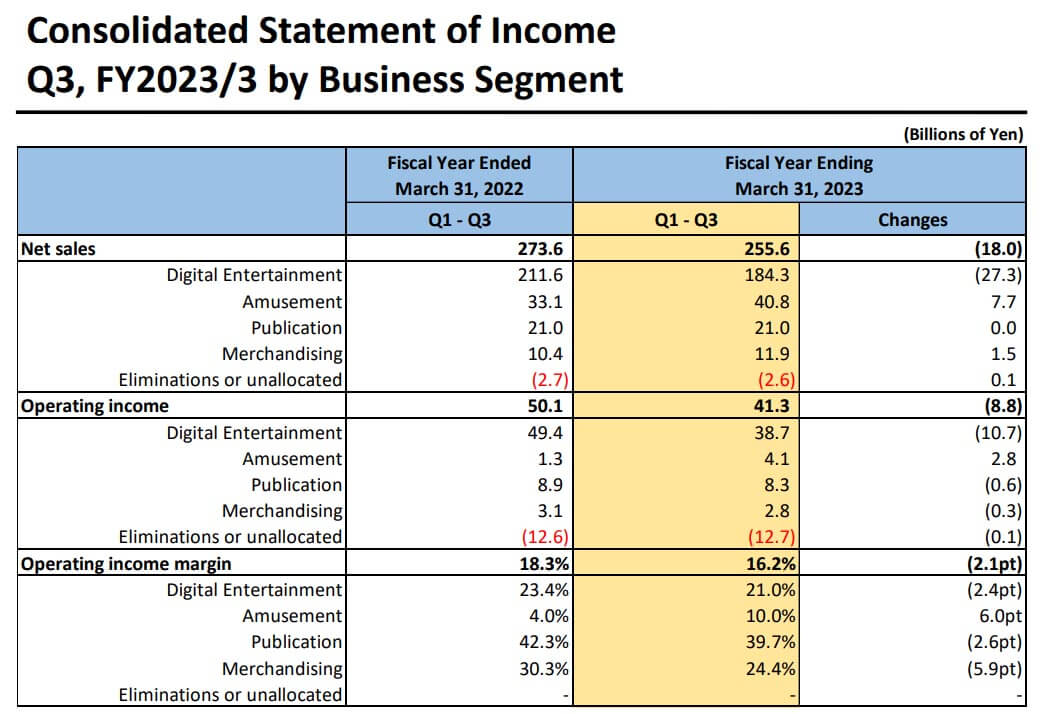

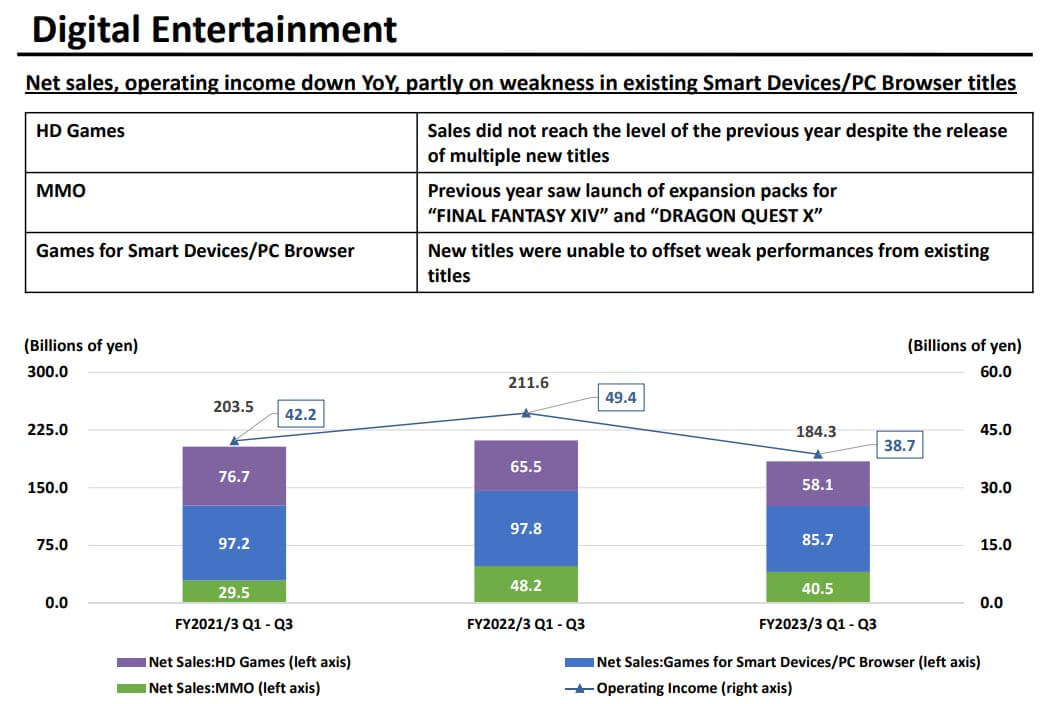

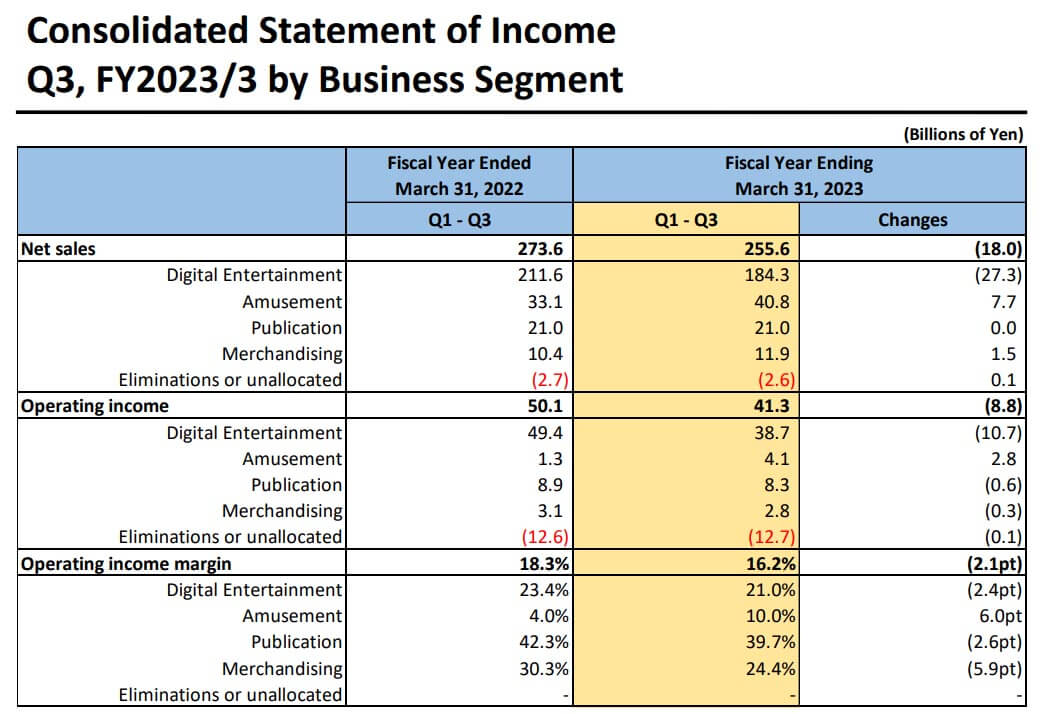

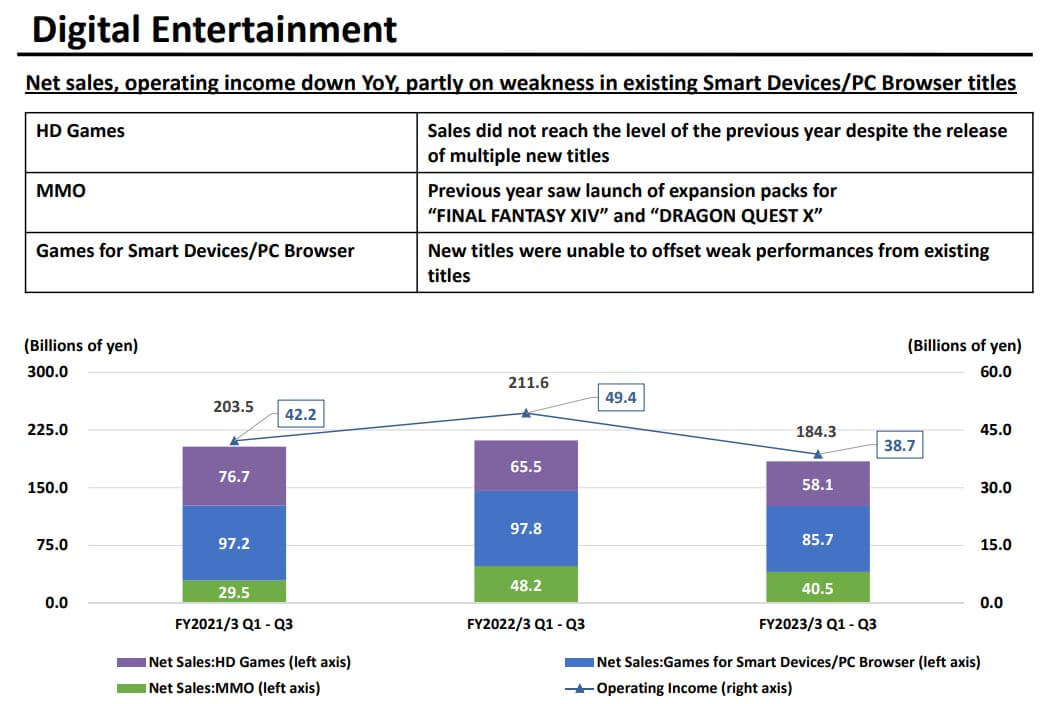

In the HD (High-Definition) Game sub-segment, the nine-month period ended December 31, 2022 saw the release of such titles as “CRISIS CORE -FINAL FANTASY VII- REUNION,” “DRAGON QUEST TREASURES,” and “Dragon Quest X.” However, because new titles generated fewer earnings than in the previous year, which had seen the launch of “OUTRIDERS,” “NieR Replicant ver. 1.22474487139...,” and “Marvel’s Guardians of the Galaxy,” the sub-segment’s net sales declined versus the same period of the previous fiscal year. Net sales declined versus the same period of the previous fiscal year in the MMO (Massively Multiplayer Online) Game sub-segment as no expansion pack was launched for “FINAL FANTASY XIV.”

The Games for Smart Devices/PC Browser sub-segment saw a decline in net sales versus the same period of the previous fiscal year because of weak performances by existing titles. In the Amusement segment, same-store sales were up sharply from the previous year, resulting in year-on-year growth in both net sales and operating income for the nine-month period ended December 31, 2022.

In the Publication segment, sales of both digital and print media were solid in the nine-month period ended December 31, 2022, but higher prices on printing paper on other inputs led to higher costs. This, combined with other factors such as increased advertising expenses, led to a year-on-year decline in operating income.

In the Merchandising segment, the nine-month period ended December 31, 2022 saw brisk sales of products including new character merchandise based on major intellectual properties. However, while net sales rose versus the same period of the previous fiscal year, operating income declined, because of changes in the sales mix by product.

Sources

Financial Results - https://www.hd.square-enix.com/eng/ir/pdf/23q3earnings.pdf

Financial Results Presentation - https://www.hd.square-enix.com/eng/ir/pdf/23q3slides.pdf

Previous threads

FY3/2023

Q1 - https://www.installbaseforum.com/fo...3-2023-april-june-2022-financial-results.974/

Q2 - https://www.installbaseforum.com/fo...-6-month-period-ended-september-30-2022.1186/

My webpage, something something: https://r134x7.github.io/nintendo-earnings-data-and-other-video-game-companies/#/square-enix

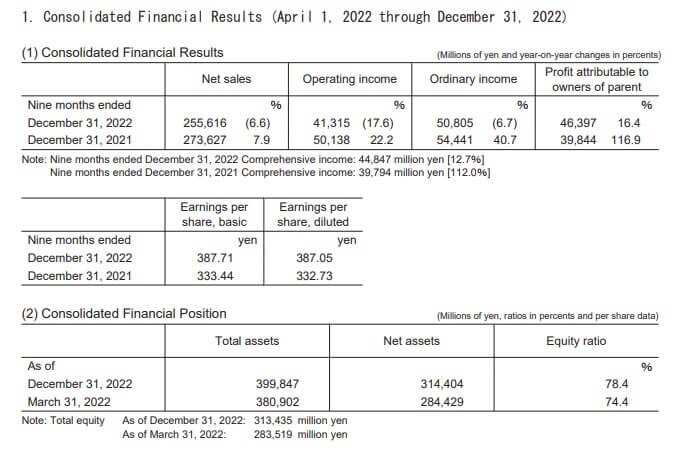

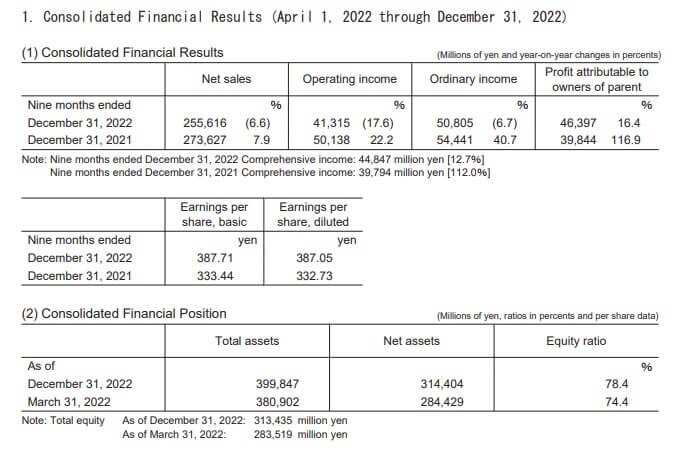

Consolidated Earnings (go to their earnings release to see why they still aren't giving a forecast) :

Sales Per Software Unit:

Consolidated Earnings (go to their earnings release to see why they still aren't giving a forecast) :

Code:

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| SQUARE ENIX HOLDINGS CO., LTD. | FY3/2023 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Consolidated Financial Results |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Data as of December 31st, 2022 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Net Sales | YoY% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥74,876M | -15.49% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥88,516M | +10.21% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥92,224M | -11.92% |

+========================================+

| 1st Half | ¥163,392M | -3.27% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3/4 | ¥255,616M | -6.58% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| See Earnings Release for forecast info. |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

###

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Operating Income | YoY% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥14,430M | -16.67% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥11,614M | -1.83% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥15,271M | -27.25% |

+========================================+

| 1st Half | ¥26,044M | -10.64% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3/4 | ¥41,315M | -17.6% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| See Earnings Release for forecast info. |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

###

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Operating Margin |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | 19.27% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | 13.12% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | 16.56% |

+============================+

| 1st Half | 15.94% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3/4 | 16.16% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| See Earnings Release for forecast info. |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

###

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Net Income | YoY% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥18,355M | +45.04% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥21,118M | +104.32% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥6,924M | -58.92% |

+========================================+

| 1st Half | ¥39,473M | +71.69% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3/4 | ¥46,397M | +16.45% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| See Earnings Release for forecast info. |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

###Sales Per Software Unit:

Code:

+−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Square Enix | FY3/2023 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Segment Information |

+−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Data as of December 31st, 2022 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| HD Games |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | Sales | YoY% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥12,000M | -52.19% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥17,400M | +20.83% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥28,700M | +10.38% |

+======================================+

| First Half | ¥29,400M | -25.57% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3 Qtrs | ¥58,100M | -11.3% |

+======================================+

| *Sales might include: - Downloadable |

| content purchases |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| MMO |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | Sales | YoY% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥14,100M | +21.55% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥14,500M | -9.94% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥11,900M | -41.95% |

+======================================+

| First Half | ¥28,600M | +3.25% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3 Qtrs | ¥40,500M | -15.98% |

+======================================+

| **MMO sales includes subscriptions |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| HD Games & MMO Sales |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥26,100M | 4.28M | ¥6,098 |

| YoY% | -28.88% | -56.68% | +64.15% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥31,900M | 5.13M | ¥6,218 |

| YoY% | +4.59% | -30.11% | +49.65% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥40,600M | 7.02M | ¥5,783 |

| YoY% | -12.69% | -42.6% | +52.1% |

+==================================================+

| First Half | ¥58,000M | 9.41M | ¥6,164 |

| YoY% | -13.69% | -45.35% | +57.97% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

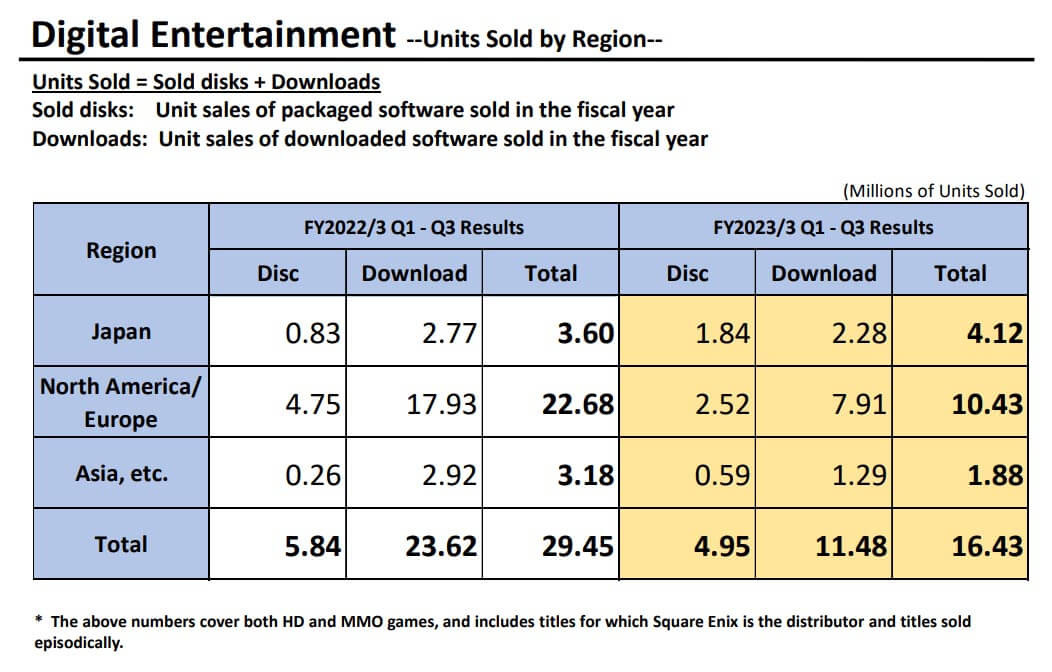

| 1st 3 Qtrs | ¥98,600M | 16.43M | ¥6,001 |

| YoY% | -13.28% | -44.21% | +55.43% |

+==================================================+

| *Sales might include: - Downloadable content |

| purchases **MMO sales includes subscriptions |

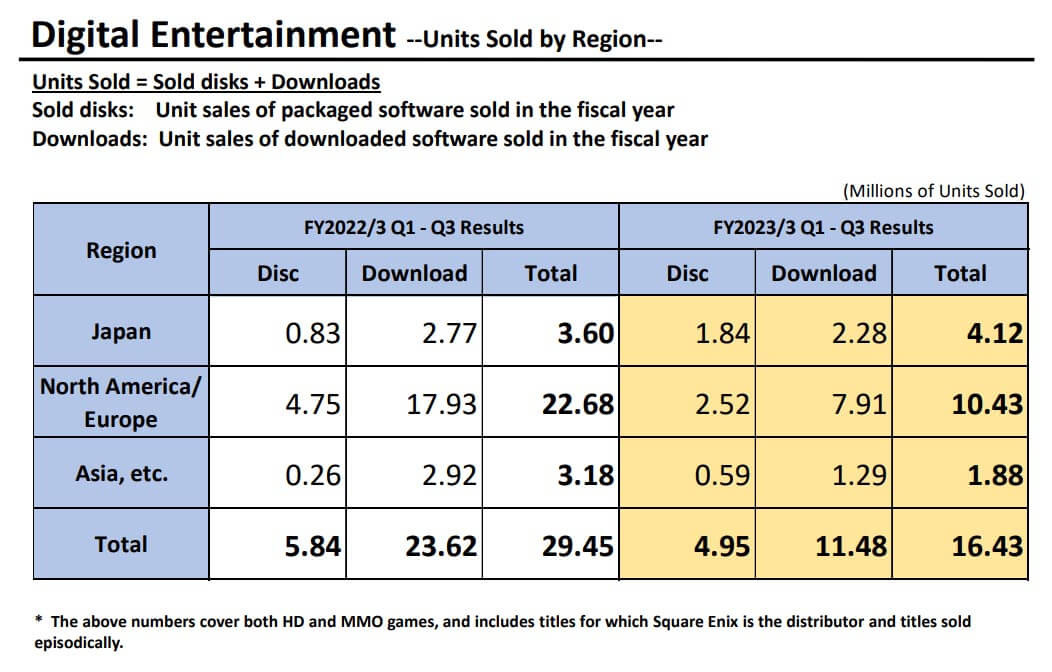

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+There's a huge gap in terms of game units sold in North America/Europe between FY2022 and FY2023, a gap of 12 million copies, which I assume can be almost completely contributed to the sale of Crystal Dynamics / Eidos, because the differences are much smaller in Japan and Asia. The digital share in NA/EU decreased from 79% to 75%, which doesn't look like much, but that's a increase in physical share from almost 1/5 to 1/4.

Games like Outriders and GotG always skewed way more toward NA/Europe than Japan, and were big sales contributors last year.There's a huge gap in terms of game units sold in North America/Europe between FY2022 and FY2023, a gap of 12 million copies, which I assume can be almost completely contributed to the sale of Crystal Dynamics / Eidos, because the differences are much smaller in Japan and Asia. The digital share in NA/EU decreased from 79% to 75%, which doesn't look like much, but that's a increase in physical share from almost 1/5 to 1/4.

Comparatively, games like Dragon Quest X Offline or Treasures are skewing way more favorably toward Japan

Yes, good point, but most of western-focused backlog games that would add sales are gone now (since 26th August 2022). Outriders and Life Is Strange stay with Square Enix, but Tomb Raider, Deus Ex, and the Marvel games are gone now. It could be interesting to see how the NA/EU "total games sold" number develops over the coming quarters to estimate the unit sales contribution of Crystal Dynamics and Eidos to Square Enix financials, even though they barely made a profit.Games like Outriders and GotG always skewed way more toward NA/Europe than Japan, and were big sales contributors last year.

I was shocked this year is down for console/PC games despite the onslaught of releases. But then I looked at last year and it was kinda just as busy.

Square Enix FY2022

Square Enix FY2023

Taito FY2022

Taito FY2023

Square Enix FY2022

- 04.01.21 Outriders (PC/PS4/PS5/XBO/XBS)

- 04.15.21 SaGa Frontier Remastered (NSW/PC/PS4)

- 04.22.21 NieR Replicant ver.1.24474487139... (PC/PS4/XBO)

- 05.04.21 Dragon Quest Builders 2 (XBO)

- 06.10.21 Final Fantasty VII: Remake Intergrade (PS5)

- 06.24.21 Legend of Mana Remastered (NSW/PC/PS4)

- 07.27.21 NEO The World Ends with You (NSW/PS4)

- 07.28.21 Final Fantasy: Pixel Remaster (PC)

- 07.28.21 Final Fantasy II: Pixel Remaster (PC)

- 07.28.21 Final Fantasy III: Pixel Remaster (PC)

- 09.02.21 Bravely Default II (PC)

- 09.08.21 Final Fantasy IV: Pixel Remaster (PC)

- 09.10.21 Life is Strange: True Colors (PC/PS4/PS5/XBO/XBS)

- 09.23.21 Actraiser Renaissance (NSW/PC/PS4)

- 09.28.21 NEO The World Ends with You (PC)

- 10.12.21 Circuit Superstars (PC/XBO)

- 10.14.21 Dungeon Encounters (NSW/PC/PS4)

- 10.21.21 Collection of SaGa: Final Fantasy Legend (PC)

- 10.26.21 Marvel's Guardians of the Galaxy (NSW/PC/PS4/PS5/XBO/XBS)

- 10.28.21 Voice of Cards: The Isle Dragon Roars (NSW/PC/PS4)

- 11.10.21 Final Fantasy V: Pixel Remaster (PC)

- 12.07.21 Life is Strange: True Colors (NSW)

- 12.16.21 Final Fantasy VII: Remake Intergrade (PC)

- 01.27.22 Circuit Superstars (PS4)

- 02.01.22 Life is Strange: Remastered Collection (PC/PS4/XBO)

- 02.10.22 Kingdom Hearts HD I.5 + II.5 Remix (NSW)

- 02.10.22 Kingdom Hearts HD 2.8 Final Chapter Prologue (NSW)

- 02.10.22 Kingdom Hearts III + Re Mind (NSW)

- 02.17.22 Voice of Cards: The Forsaken Maiden (NSW/PC/PS4)

- 02.23.22 Final Fantasy VI: Pixel Remaster (PC)

- 02.28.22 Babylon's Fall (PC/PS4/PS5)

- 03.04.22 Triangle Strategy (NSW) Nintendo

- 03.10.22 Chocobo GP (NSW)

- 03.14.22 Stranger of Paradise: Final Fantasy Origin (PC/PS4/PS5/XBO/XBS)

Square Enix FY2023

- 04.07.22 Chrono Cross: The Radical Dreamers Edition (NSW/PC/PS4/XBO)

- 05.11.22 The Centennial Case: A Shijima Story (NSW/PC/PS4/PS5)

- 07.14.22 PowerWash Simulator (PC/XBO/XBS)

- 07.22.22 Live A Live (NSW) Nintendo

- 09.12.22 Voice of Cards: The Beasts of Burden (NSW/PC/PS4)

- 09.13.22 Various Daylife (NSW/PC/PS4)

- 09.15.22 Dragon Quest X: Rise of the Five Tribes Offline (NSW/PC/PS4/PS5)

- 09.22.22 The DioField Chronicle (NSW/PC/PS4/PS5/XBO/XBS)

- 09.27.22 Life is Strange: The Arcadia Bay Collection (NSW)

- 09.29.22 Valkyrie Elysium (PS4/PS5)

- 10.06.22 NieR Automata: The End of YoRHa Edition (NSW)

- 10.13.21 Triangle Strategy (PC)

- 10.27.21 Star Ocean: The Divine Force (PC/PS4/PS5/XBO/XBS)

- 11.04.22 Harvestella (NSW/PC)

- 11.11.22 Tactics Ogre Reborn (NSW/PC/PS4/PS5)

- 11.11.22 Valkyrie Elysium (PC)

- 12.01.22 Romancing SaGa: Minstrel Song Remastered (NSW/PC/PS4/PS5)

- 12.09.22 Dragon Quest Treasures (NSW)

- 12.13.22 Crisis Core: Final Fantasy Reborn (NSW/PC/PS4/PS5/XBO/XBS)

- 12.21.22 Valkyrie Profile: Lenneth (PS4/PS5)

- 01.24.23 Forspoken (PC/PS5)

- 01.31.23 PowerWash Simulator (NSW/PS4/PS5)

- 02.02.23 Life is Strange 2 (NSW)

- 02.16.23 Theathrythm Final Bar Line (NSW/PS4)

- 02.24.23 Octopath Traveler II (NSW/PC/PS4/PS5)

Taito FY2022

- 09.30.21 Bubble Bobble 4 Friends (PC)

- 11.17.21 Darius Cozmic Collection: Arcade (PC)

- 02.24.22 Taito Milestones (NSW) ININ Games

- 03.02.22 Taito Egret II Mini

- 03.30.22 G-Darius HD (PC)

Taito FY2023

- 10.27.22 Dariusburst CS Core + Taito / Sega Pack (NSW)

- 03.09.23 Ray'z Arcade Chronology (NSW/PS4) ININ Games

If you didn't go to their earnings release to read why they still don't have a forecast:

(3) Qualitative information on consolidated business forecasts

As a result of digitization and other technological advances, consumer game content is increasingly sold via downloads rather than physical packages. Monetization methods such as free-to-play, microtransactions, and subscriptions have also given rise to a greater diversity of business models outside the confines of traditional one-off sales. As such, the consumer game market continues to grow.

In the market for games for smart devices, increasingly sophisticated smartphones are making customers demand even richer gaming experiences and enabling greater diversity in game design and business models. Led by the Western and Asian regions, the size of the market also continues to expand globally.

Meanwhile, a familiar list of titles continues to dominate the upper end of the smart device game rankings in Japan, and the increased presence of Asian players in the Japanese market has intensified competition, reducing the odds of new titles succeeding.

By developing content and diversifying earnings opportunities in line with this changing environment, the Group is working to establish an earnings platform with the goal of enabling sustained growth in sales and profits.

As stated in the Company’s Consolidated Financial Results for the Six-Month Period Ended September 30, 2022, the Company is refraining from disclosing consolidated financial forecasts for the fiscal year through March 31, 2023 as it has determined that formulating reasonable calculations would be difficult.

- Pronouns

- He/Him

I assume Forspoken expenses were already taken into account in past reports, so whether numbers next quarterly report will be down or up vs previous years' 4th quarter should depend more on what these had as software output.Despite the results not being great, it just feels like the calm before the Forspoken storm.

Edit: Previous 4th quarter they had:

01.27.22 Circuit Superstars (PS4)

02.01.22 Life is Strange: Remastered Collection (PC/PS4/XBO)

02.10.22 Kingdom Hearts HD I.5 + II.5 Remix (NSW)

02.10.22 Kingdom Hearts HD 2.8 Final Chapter Prologue (NSW)

02.10.22 Kingdom Hearts III + Re Mind (NSW)

02.17.22 Voice of Cards: The Forsaken Maiden (NSW/PC/PS4)

02.23.22 Final Fantasy VI: Pixel Remaster (PC)

02.28.22 Babylon's Fall (PC/PS4/PS5)

03.04.22 Triangle Strategy (NSW) Nintendo

03.10.22 Chocobo GP (NSW)

03.14.22 Stranger of Paradise: Final Fantasy Origin (PC/PS4/PS5/XBO/XBS)

Vs this quarter

- 01.24.23 Forspoken (PC/PS5)

- 01.31.23 PowerWash Simulator (NSW/PS4/PS5)

- 02.02.23 Life is Strange 2 (NSW)

- 02.16.23 Theathrythm Final Bar Line (NSW/PS4)

- 02.24.23 Octopath Traveler II (NSW/PC/PS4/PS5)

Hmm...

Last edited:

- Pronouns

- He/Him

Actually pretty good results considering so far they have lacked the big tentpole SE games. Next few years will be big.

I assume Forspoken expenses were already taken into account in past reports

I think they only recognize the development costs after their games release.

This is what they said in the quarter Avengers launched (and they had like a 6B¥ loss in the HD segment):

The HD Games sub-segment posted an operating loss as initial sales of “Marvel’s Avengers” were lower than we had expected and unable to completely offset the amortization of the game’s development costs. In the second half of the fiscal year (“2H”), we hope to make up for slow initial sales by offering ample additional content to grow our sales.

And this was still the case for the next quarter (where they had another ~4B¥ loss).

I will start with the HD Games sub-segment, where we booked a quarterly operating loss in 3Q, owed in part to the remaining “Marvel’s Avengers” development costs that hadn’t been fully amortized in 2Q and to relatively slow sales, on the whole, during the holiday season.