I'm not strong with accounting (also haven't looked at the financial statement tbh) so I am asking, where is Sony paying the acquisition costs from? I would assume they didn't just pull it straight from cash (well kind of, they'll book cash through other activities but yeah. And actually thinking about it I haven't looked at the cash reserves so maybe they are just paying jt down more aggressively through cash reserves). So they could have taken on more debt. I don't think they did stock swaps or anything of that nature.

I would think that even if it isn't appearing as a expense item on the income statement (though I would assume that the acquisition costs are going to have an expense component baked into Cost of Sales), it would naturally have to have some hit to the income statement somewhere for the statement of financial position to level out.

But honestly, I'm not sure, I tried to do a basic google search but I feel like I would have to get into the weeds to really understand it. Do you have a simple explanation?

How you book acquisition has nothing to do with how you finance the acquisition.

Basically when you buy a company, let’s say for $1m. This typically means that you buy their shares for $1m inclusive of legal fees.

The accounting journal entry would be

Dr Investment

Cr Liability/Cash/Shares

The credit part can be in various form:

1. Cash

2. Liability (e.g bond)

3. Equity

People can get creative and structure the payment in various forms and combinations.

As you can see, both entries are Balance Sheet items.

How acquisition impact P&L can be because of the following:

1. Indirect cost that you cannot capitalize, hence must be expensed in the same period. For example when you buy company A, you require their CEO to stay for 3 years. His salary for the 3 years can be argued to not be a direct cost of acquisition

2. Impairment of investment. You can acquire a company then few months later find out the company is not worth as much as you thought

3. Loss on acquisition due to difference between Acquisition Price and Fair Value of the company. For Gain, it would generally be recorded as Goodwill.

4. Consolidating a new subsidiary can have positive or negative impact to your P&L

If you’re curious to know more, you can read on IFRS 3 about Business Combinations. I think they even have an explanation pdf with some simple examples somewhere online.

...I know? I told you it's only part of that $3.6b cost goes into P&L. Like retention bonuses, CEO bonuses, etc.

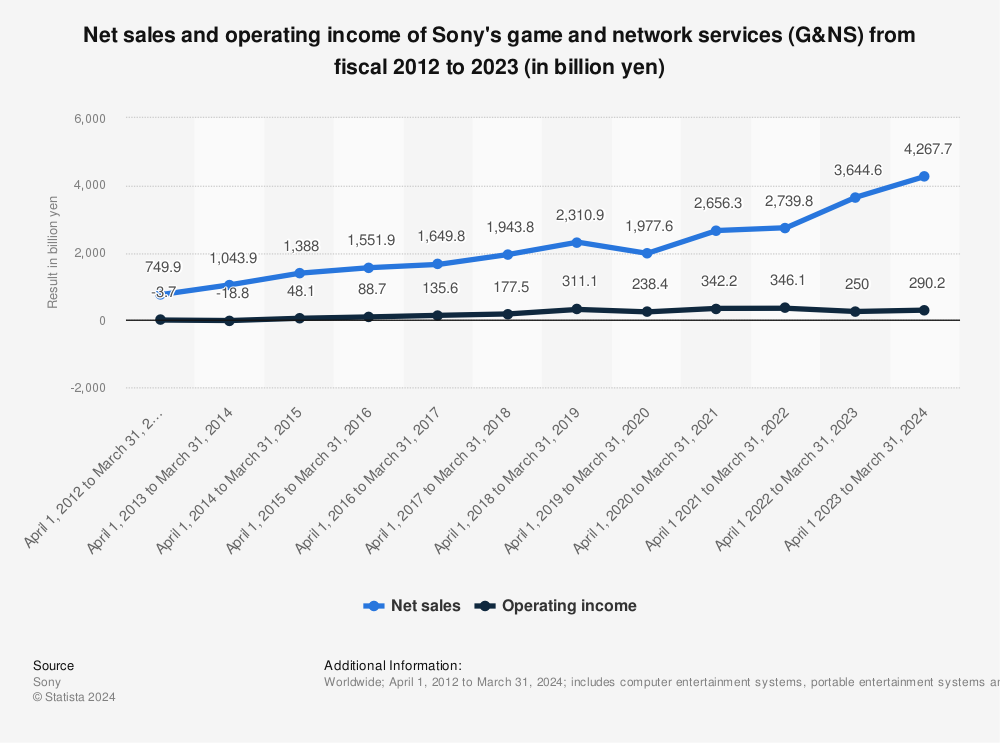

And since people argue Sony’s Operating Margin is significantly impacted by acquisition, there should be number somewhere that says so. But it doesn’t seem like Sony provides the exact impact of acquisition on their P&L.

By default, acquisition has minimal impact on P&L, so I think it’s logical to say that some people here overstated Bungie acquisition impact on Sony Operating Margin.