You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

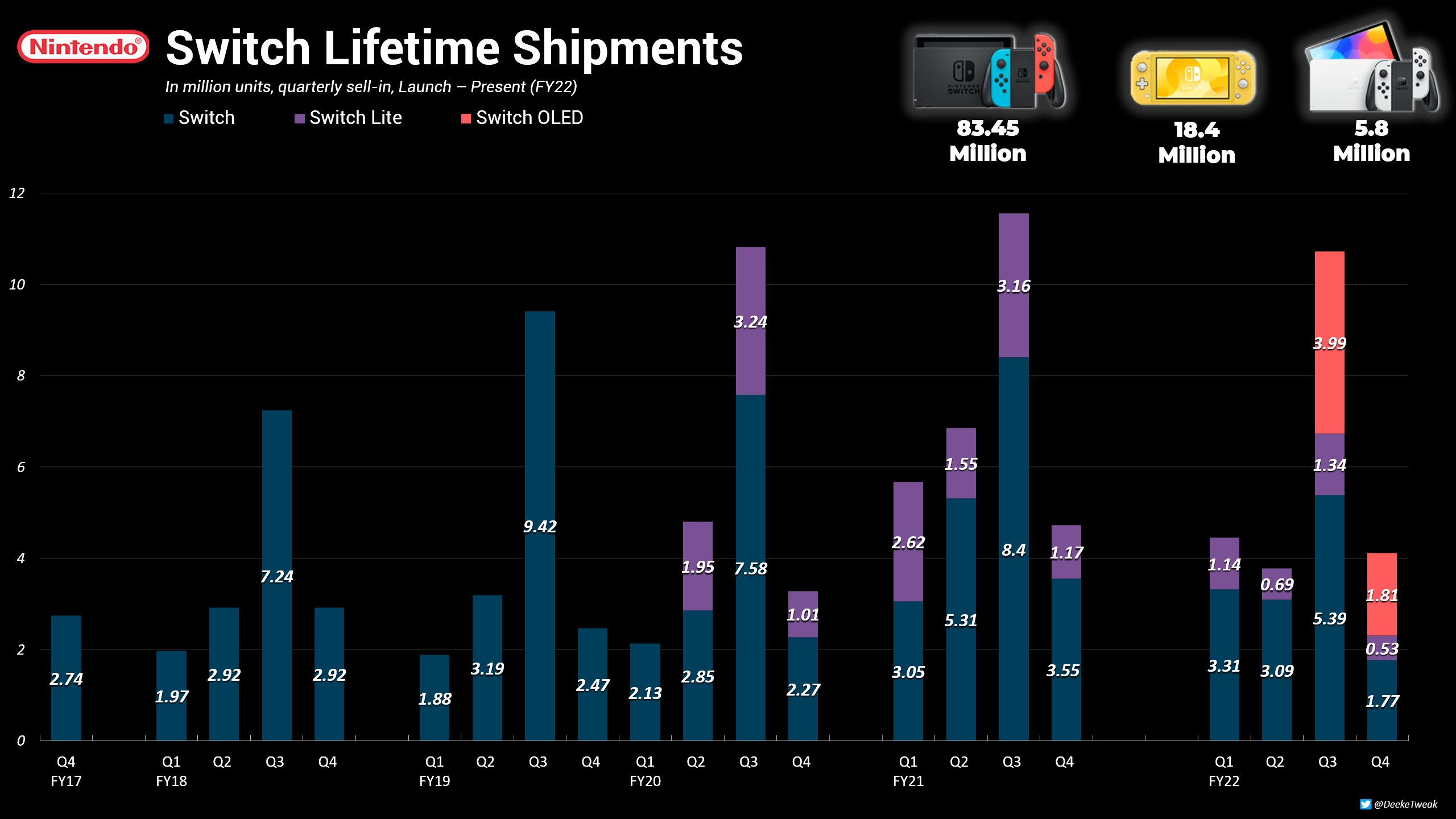

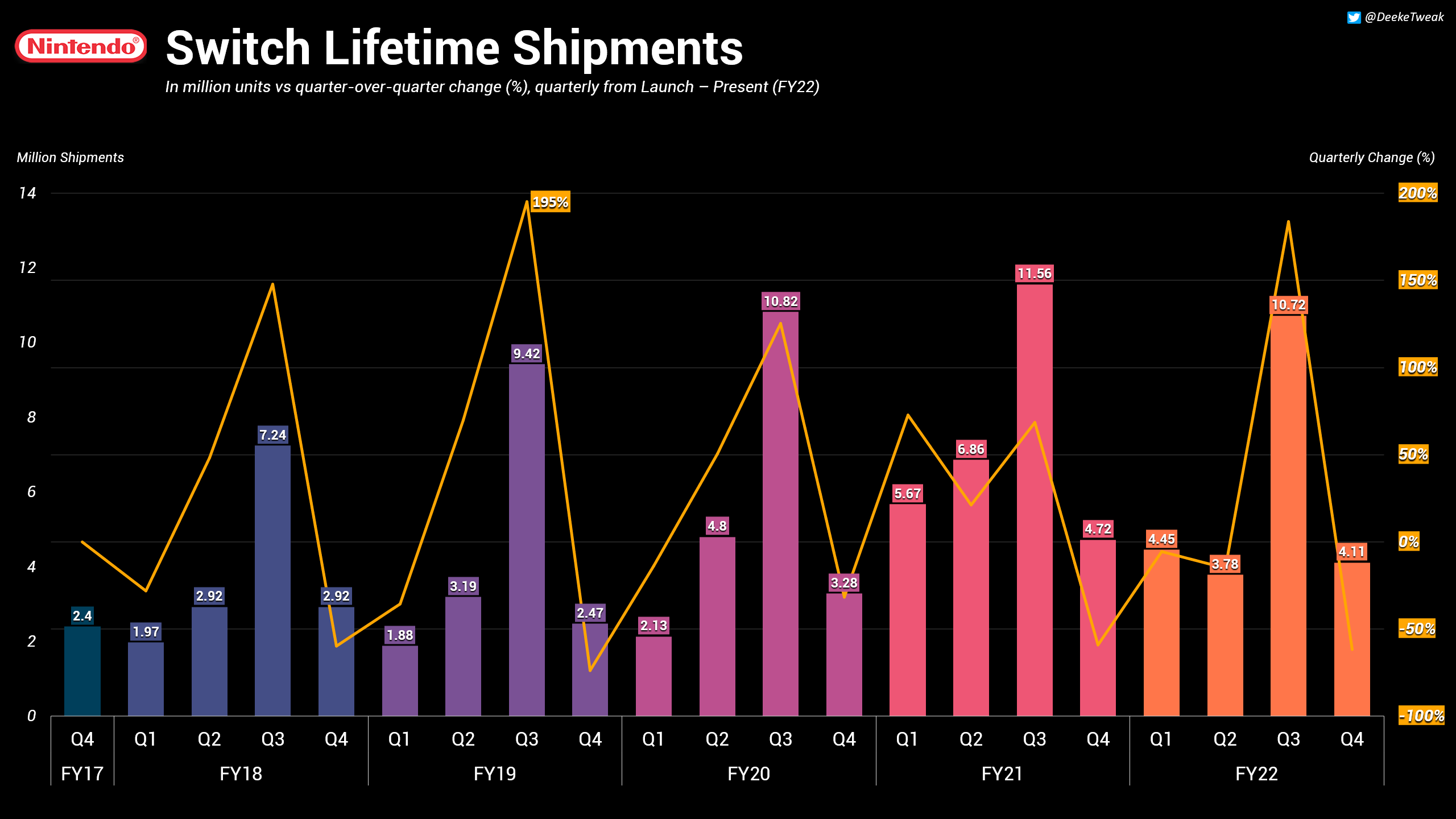

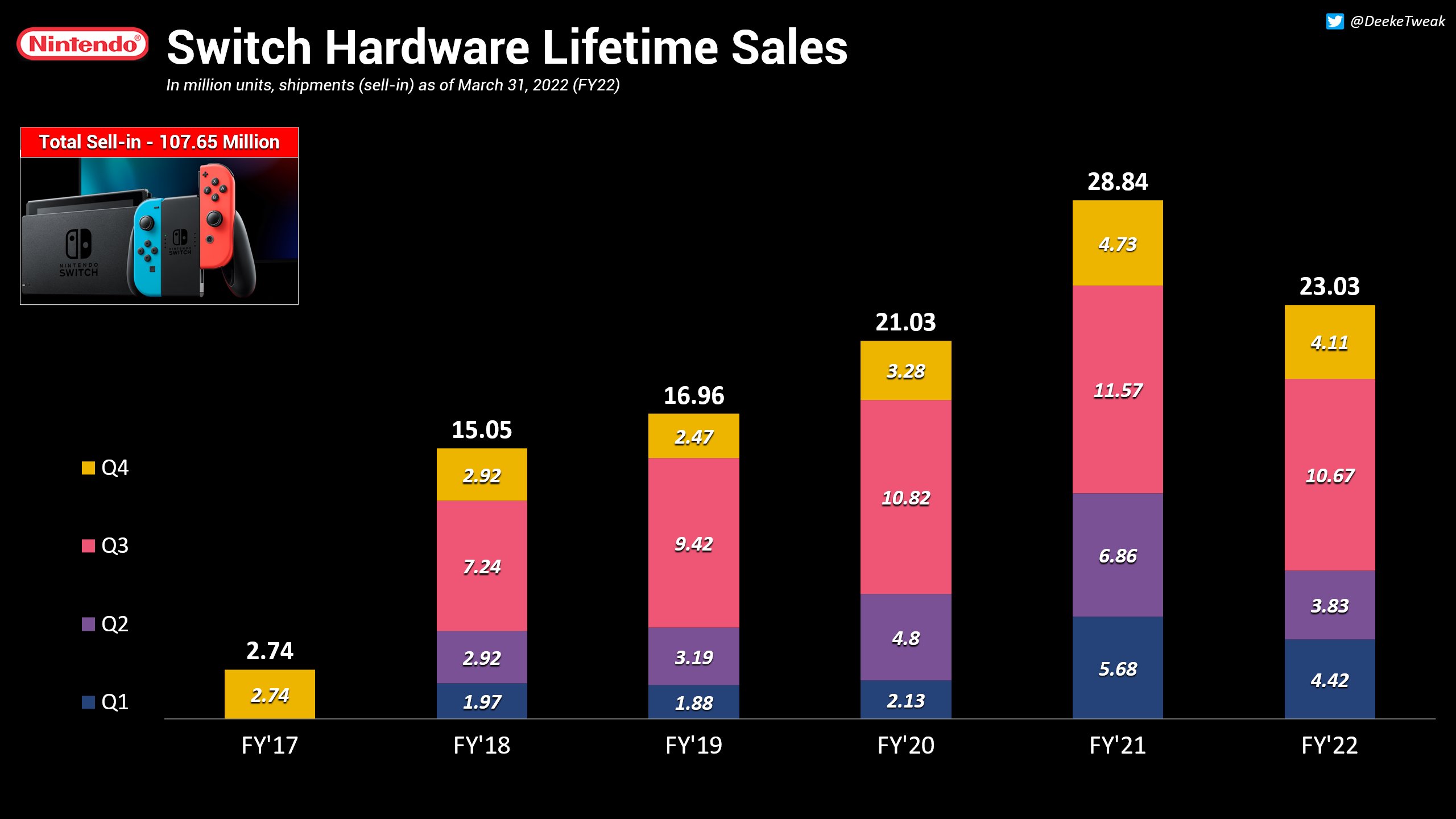

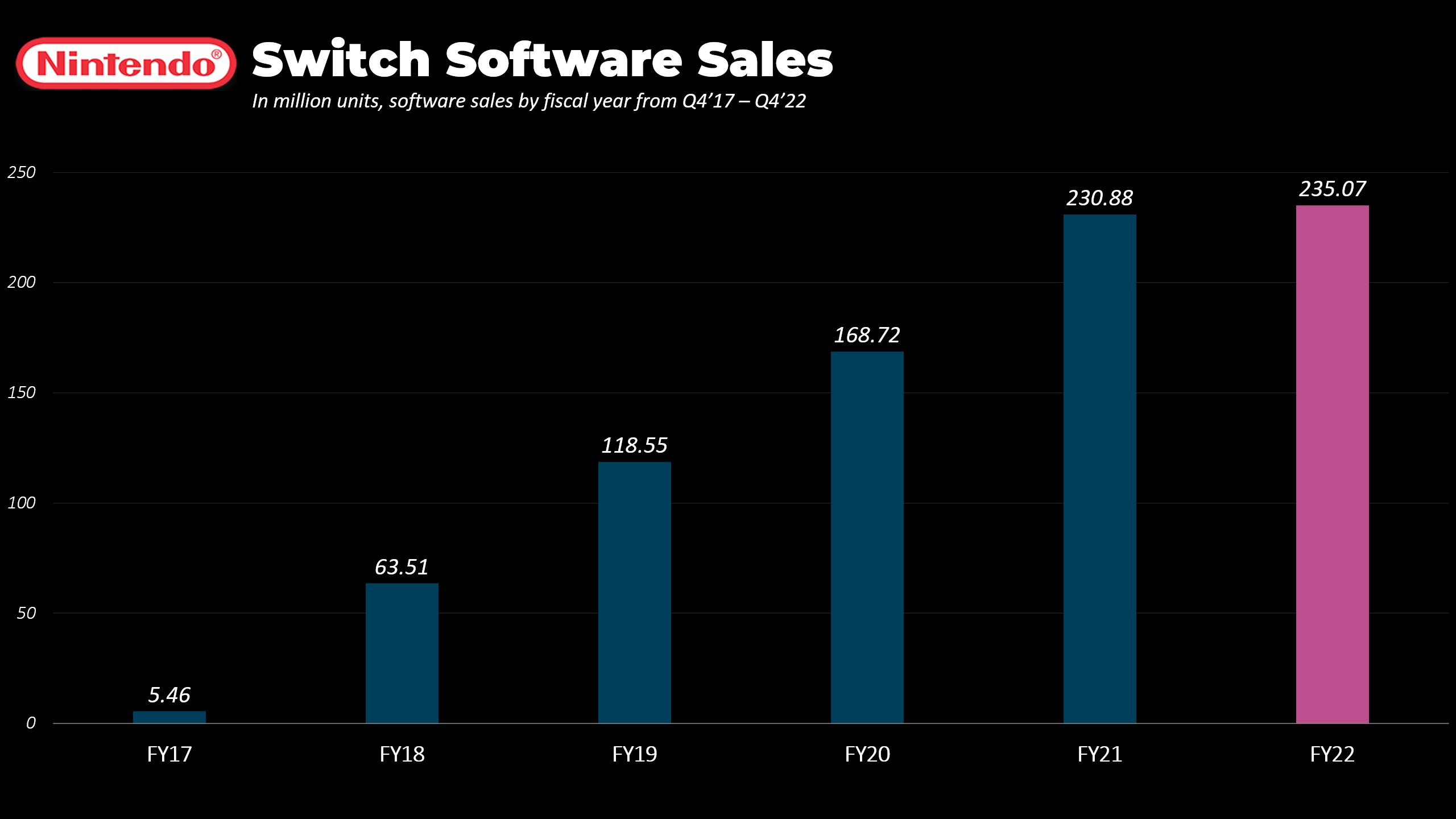

Nintendo FY3/2022 Q4 Earnings Release, Switch Hardware Q4 - 4.11M ( -13.1% YoY), 107.65M LTD

- Thread starter ggx2ac

- Replies 296

- Views 24,514

- Start date

- Financial Results

Interesting perspective.This is the kind of stat that doesn't come up much, but I think is worth considering when systems have very different sales patterns. Like, GameCube hardware peaked before it finished its second year, Wii peaked before it finished its third year, Switch peaked early in its fifth year. So through 21 quarters the average GameCube owner had had their system about 3.1 years, while for Wii it was 2.7 years and is 2.3 years for Switch. Or at least, that's the average time each system had been shipped--probably safer to assume the Switches were actually mostly in homes while GameCubes spent more time on shelves.

I think this goes to partially explaining why Switch lags behind those two in software tie ratio, though not completely. Through 21 quarters GCN's tie ratio was 9.3, but was 8.7 when its owners were as "young" as Switch. Wii's tie ratio through 21 quarters was 8.5, but was 8.3 when its owners were as "young" as Switch. Still both ahead of Switch's current 7.6.

Of course, the unreported digital-only games throws a wrench into any comparison.

- Pronouns

- He/Him

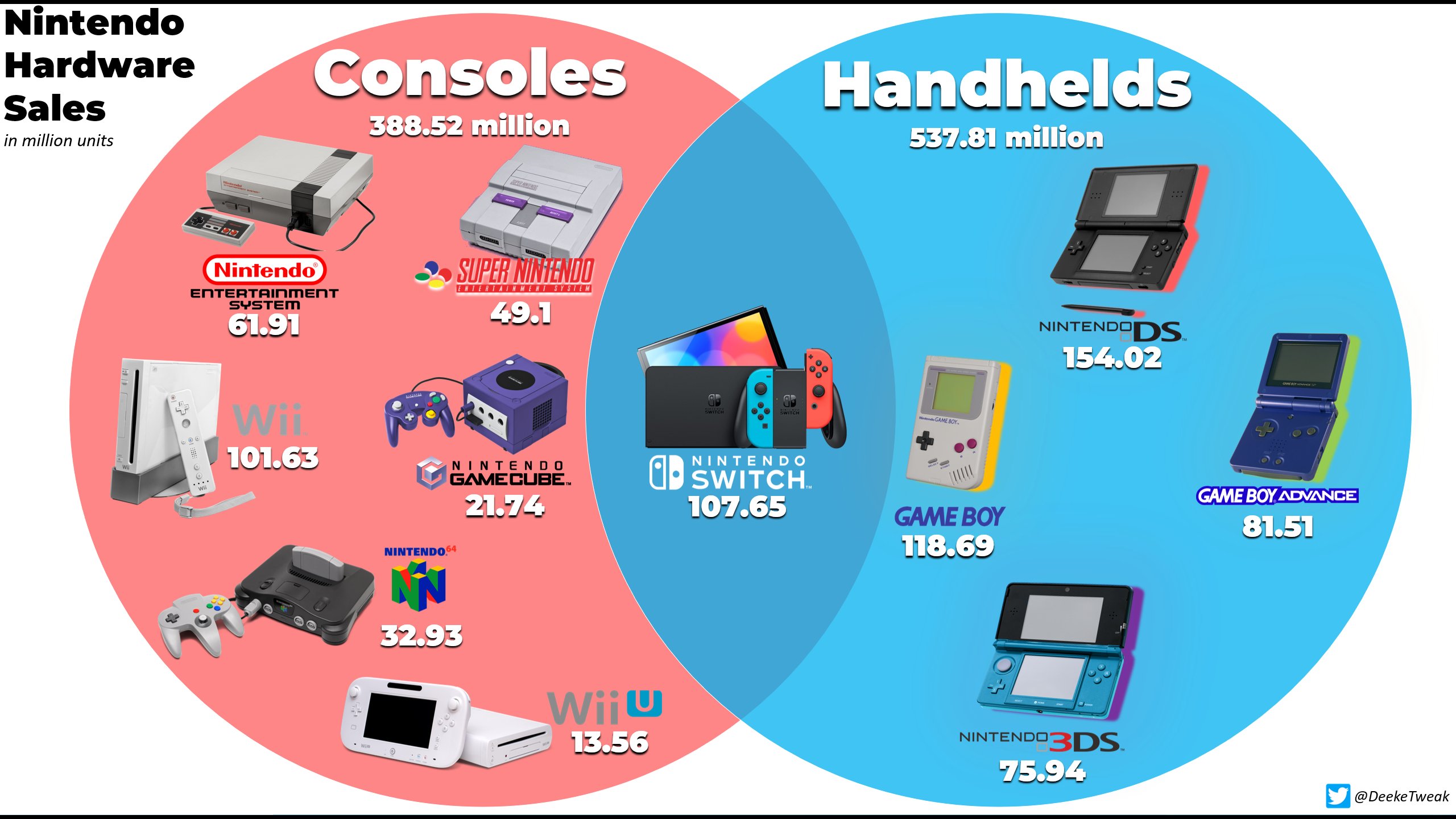

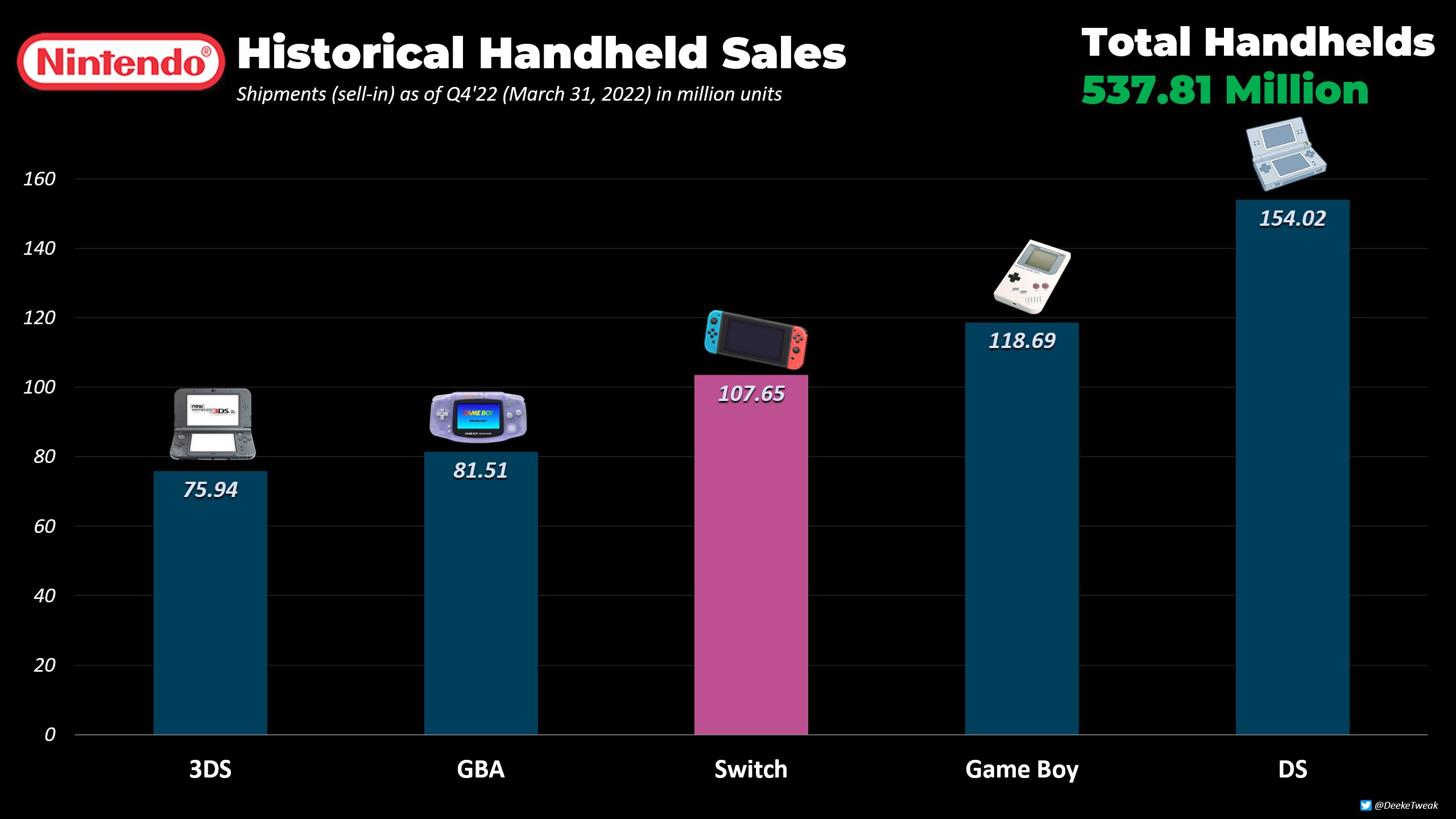

Visualizing this is helpful. So it’s highly likely to blow past WW Game Boy sales by the end of the year and become the 2nd-best selling Nintendo hardware of all time and the 3rd-best selling video game hardware for all manufacturers (since it‘ll likely also pass PS4 WW, as well)

Based on Nintendo's projections, it should easily pass PS4 & Game Boy by the end of the year. Should end the year around 124 million.Visualizing this is helpful. So it’s highly likely to blow past WW Game Boy sales by the end of the year and become the 2nd-best selling Nintendo hardware of all time and the 3rd-best selling video game hardware for all manufacturers (since it‘ll likely also pass PS4 WW, as well)

I think it's more a case that even with reduced production of the Lite, it's easily meeting demand for it.Thnaks for the pics @acezam

Can we assume Nintendo "sacrificied" the Switch Lite in term of components to produce enough OG/OLED models?

The Lite was released based on the understandable assumption that the market wanted a cheaper, handheld only version of the Switch.

Instead, OG remained the preferred model by a wide margin, and now the market is indicating it will pay a premium for a fancier version of the OG.

This is very much new territory for Nintendo as a company. I do wonder now if a Wii HD branded as such would've done far better than Wii U. Low bar to clear, I know, and the existing/potential audience during the Wii-Wii U transition might be very different from the audience that Switch has cultivated.

Regardless, I think heavy demand for OLED and light demand for Lite should be instructive to Nintendo as it moves forward.

love how Bloomberg paints the latest figures

"Kyoto-based Nintendo reported lackluster financial results last week as the creator of Super Mario struggles to revitalize its five-year-old Switch console and manage a global chip shortage. The company projected full-year operating income below analysts’ estimates and said it’s expecting to sell 21 million Switch devices this year, shy of the 21.7 million anticipated."

www.bloomberg.com

www.bloomberg.com

"Kyoto-based Nintendo reported lackluster financial results last week as the creator of Super Mario struggles to revitalize its five-year-old Switch console and manage a global chip shortage. The company projected full-year operating income below analysts’ estimates and said it’s expecting to sell 21 million Switch devices this year, shy of the 21.7 million anticipated."

Saudi Arabia’s PIF Adds to Games Push With 5% Nintendo Stake

Saudi Arabia’s Public Investment Fund took a 5.01% stake in Nintendo Co., its third investment in a Japanese games company as the industry consolidates.

It's such nonsensical framing. They're struggling to revitalize a console for which they also can't keep up with demand because of the global chip shortage?Did they actually have lackluster financial results? What would count as revitalizing?

Doom figure, nonsensical framing, moral panic, and orientalism? if Nintendo with almost 6bi profit is lackluster just imagine other companies?love how Bloomberg paints the latest figures

"Kyoto-based Nintendo reported lackluster financial results last week as the creator of Super Mario struggles to revitalize its five-year-old Switch console and manage a global chip shortage. The company projected full-year operating income below analysts’ estimates and said it’s expecting to sell 21 million Switch devices this year, shy of the 21.7 million anticipated."

Saudi Arabia’s PIF Adds to Games Push With 5% Nintendo Stake

Saudi Arabia’s Public Investment Fund took a 5.01% stake in Nintendo Co., its third investment in a Japanese games company as the industry consolidates.www.bloomberg.com

Fiendslayer

Banned

Perma-ban : Multiple infractions, reports and no signs of an improved behavior

love how Bloomberg paints the latest figures

"Kyoto-based Nintendo reported lackluster financial results last week as the creator of Super Mario struggles to revitalize its five-year-old Switch console and manage a global chip shortage. The company projected full-year operating income below analysts’ estimates and said it’s expecting to sell 21 million Switch devices this year, shy of the 21.7 million anticipated."

Saudi Arabia’s PIF Adds to Games Push With 5% Nintendo Stake

Saudi Arabia’s Public Investment Fund took a 5.01% stake in Nintendo Co., its third investment in a Japanese games company as the industry consolidates.www.bloomberg.com

Did they actually have lackluster financial results? What would count as revitalizing?

It's such nonsensical framing. They're struggling to revitalize a console for which they also can't keep up with demand because of the global chip shortage?

Doom figure, nonsensical framing, moral panic, and orientalism? if Nintendo with almost 6bi profit is lackluster just imagine other companies?

I think y'all don't fully understand what investors are looking for (which is where Bloomberg's writing is orientated towards)

The goal for investors is the story of "forever growth". They don't really care about the current performance. or stability, or "records" (unless its record profits/revenue projected for next year and the next and the next...).

From the perspective of investors, Nintendo's results are "bad" in the sense that this year's business (23mil) is less good than last year (28mil), and next year's business is projected to be worse (21mil). SW is also kind of projected to be stable or down next year. Nintendo has not shown any other growth avenues to offset this decline of the main Switch business.

- Nintendo has not expanded seriously, and seems to be winding down, its mobile efforts

- Nintendo has not yet substantially made its subscription services side able to offset cyclic declines (unlike Sony).

- Nintendo hasn't attempted MTX/service games which is the way most major game companies smooth out revenue cycles.

- The so-called multimedia, IP license moves have been EXTREMELY slow. The Mario movie is nowhere to be seen, Detective Pikachu failed and there has been no major pushes for other IPs.

- There is no news on any action taken to arrest Switch sales decline, other than "relying on SW" which they already did for the last FY and failed to arrest decline.

Unlike console fanboys, investors don't care that the console sells the "most amounts ever", or that profits are somewhat stable and objectively a big number (0.6% growth), or that it gets "Game of the Millennium" via BOTW2, or all of the IP sold "most ever on Switch". They are looking for avenues of growth that drives the value of the stock upwards, and they found nothing in Nintendo.

When you have chief Nintendo-cheerleader in Japan, Hideki Yasuda, being down, you know that nobody in the analyst side is too impressed with what Nintendo is doing. This is normal, analysts also tend to look at things from a stock price perspective. It doesn't mean y'all are wrong, or that Bloomberg ( and analyst and investors) are right, it is just the two different groups are looking for different things,

Last edited:

I would argue it is not always about forever growth with investors and further caution people against this idea that things like stable revenue and improved profitability dont matter. Growth without profitability doesn't mean anything. Investors care about economic benefits which you don't get if you only live in growth land. Those end up being shitty investors frankly. There are lots of high "growth" startups that wont make fuck all investors can waste their money on if that was actually true. Should really stop with this "growth" is all that matters line.

Anyway, what is true is that Nintendo is pretty stable and they haven't given any real reason to imo, promote buying their stock (outside of the stock split making it easier for retail investors to buy-in which also signifies they do expect growth in the future imo). It'll do what you expect it to since the core business looks stable but I do think @Fiendslayer is right in that the outlook doesn't suggest you're going to make any major gains if you buy. I'm not a finance expert (like at all, I actually despise finance) but it looks more like a hold or sell to me.

Many institutional investors probably would feel they can find better use for their money based of the landscape Nintendo has provided. Obviously many others will like the stability it adds to their portfolio and obviously depending on the portfolio things like hedging come into play as well. I wouldn't call these results bad. That's silly. I would say they are unexciting. That comes with it's own set of challenges and strategies for investors.

I guess the question to ask is if you have Nintendo stock is would you buy, sell or hold based on these results?

Anyway, what is true is that Nintendo is pretty stable and they haven't given any real reason to imo, promote buying their stock (outside of the stock split making it easier for retail investors to buy-in which also signifies they do expect growth in the future imo). It'll do what you expect it to since the core business looks stable but I do think @Fiendslayer is right in that the outlook doesn't suggest you're going to make any major gains if you buy. I'm not a finance expert (like at all, I actually despise finance) but it looks more like a hold or sell to me.

Many institutional investors probably would feel they can find better use for their money based of the landscape Nintendo has provided. Obviously many others will like the stability it adds to their portfolio and obviously depending on the portfolio things like hedging come into play as well. I wouldn't call these results bad. That's silly. I would say they are unexciting. That comes with it's own set of challenges and strategies for investors.

Revitalize something that is more alive than ever doesn't make sense.

I guess the question to ask is if you have Nintendo stock is would you buy, sell or hold based on these results?

EDIT: Moved to the Nintendo sales archive thread.

www.installbaseforum.com

www.installbaseforum.com

Nintendo software and hardware sales data from 1983 to present

I’m not sure about that. It seems like It’s all XC2. There were definitely some people who started the series with Definitive Edition and tried out Xenoblade 2 afterwards. The question is how many.

Last edited:

I'm sorry but saying that investors look at one thing it's a bit pessimistic about the current landscape.

ESG is all the rage and Nintendo leads in this area in several ways, I could t talk on this topic but it's not really the best place to discuss it.

Currently they remain very undervalued but their stock split is likely going to change this and is likely one of the reasons Saudi Arabia was able to snap up 5% all of the sudden

ESG is all the rage and Nintendo leads in this area in several ways, I could t talk on this topic but it's not really the best place to discuss it.

Currently they remain very undervalued but their stock split is likely going to change this and is likely one of the reasons Saudi Arabia was able to snap up 5% all of the sudden

I'm sorry but saying that investors look at one thing it's a bit pessimistic about the current landscape.

ESG is all the rage and Nintendo leads in this area in several ways, I could t talk on this topic but it's not really the best place to discuss it.

Currently they remain very undervalued but their stock split is likely going to change this and is likely one of the reasons Saudi Arabia was able to snap up 5% all of the sudden

What valuation method did you use to determine that they are undervalued? (I'm just interested tbh) Just valuation by multiples or DCF or some other model?

I personally don't see a huge issue with Bloomberg's piece. Mostly a whatever imo. The financials were very good imo but I didn't see anything crazy that should be turning heads. If you think the stock is super undervalued I'd be interested in knowing why.

Stock split says to me they have confidence in growth and that they wanted it to be easier for retail investors to buy.

- Pronouns

- He/Him

When 23 million consoles in year 5 is lackluster lol, these people are clueless.

- Pronouns

- He/Him

Shouldn't investors expect what Nintendo forecasts? Nintendo forecast 23 million hardware and 220 million software which were both achieved.It’s lackluster compared to what investors were expecting. This is written for investors. Although the revitalization part still makes no sense.

No they have their own estimates and expectations. Nintendo already low balls their software, so there’s little point for an investor to make that the expectation as well.Shouldn't investors expect what Nintendo forecasts? Nintendo forecast 23 million hardware and 220 million software which were both achieved.

When 23 million consoles in year 5 is lackluster lol, these people are clueless.

I dunno why people consistently look at it like this when that's not how investors review performance. There is a difference between a company being healthy and well run and a company being an exciting investment opportunity. Not saying Bloomberg is right but the suggestion is not that Nintendo is doing poorly.

Shouldn't investors expect what Nintendo forecasts? Nintendo forecast 23 million hardware and 220 million software which were both achieved.

Would you just take what a company says they'll do at face value and give them your money? It's more likely that institutional investors would generate their own projections.

This is a very good post that I completely agree with.Visualizing this is helpful. So it’s highly likely to blow past WW Game Boy sales by the end of the year and become the 2nd-best selling Nintendo hardware of all time and the 3rd-best selling video game hardware for all manufacturers (since it‘ll likely also pass PS4 WW, as well)

I also would love for him to explain as well. Some of us including myself are not very educated when it comes to this type of thing. So I also want to know why he thinks Nintendo stock can be perceived as undervalued.What valuation method did you use to determine that they are undervalued? (I'm just interested tbh) Just valuation by multiples or DCF or some other model?

I personally don't see a huge issue with Bloomberg's piece. Mostly a whatever imo. The financials were very good imo but I didn't see anything crazy that should be turning heads. If you think the stock is super undervalued I'd be interested in knowing why.

Stock split says to me they have confidence in growth and that they wanted it to be easier for retail investors to buy.

What valuation method did you use to determine that they are undervalued? (I'm just interested tbh) Just valuation by multiples or DCF or some other model?

I personally don't see a huge issue with Bloomberg's piece. Mostly a whatever imo. The financials were very good imo but I didn't see anything crazy that should be turning heads. If you think the stock is super undervalued I'd be interested in knowing why.

Stock split says to me they have confidence in growth and that they wanted it to be easier for retail investors to buy.

I'm not talking about me personally, just seeing the immense growth in ESG funds and investments in recent years.

ESG is investing which prioritizes optimal environmental, social, and governance factors or outcomes. Widely seen as a way of investing “sustainably”—where investments are made with consideration of the environment and human wellbeing, as well as the economy. It is based upon the growing assumption that the financial performance of organizations is increasingly affected by environmental and social factors.

From a perspective of environmental impact we need to look at Nintendo's competitors in the hardware space be it Mobile, Console or PC manufacturers. In terms of energy efficiency since the Wii - Nintendo has had the most energy efficient devices on the market - granted in the case of Mobile and PC those devices also serve a duel purpose thats important regarding another societal factor -inclusion, as currently someone without access to mobile/pc is actually excluded in many ways.

Secondly with rising digital means the expansion of digital distribution, which means that Nintendo is slowly transitioning it's physical media towards a more sustainable digital alternative but not at a tempo where it adversely impacts their retail partners. While MS & Sony and especially Valve could be seen as leaders in this field, it's actually Nintendo that has the biggest growth potential due to the slower adoption of this new way to deliver their games.

Next we can look at social factors, inclusion being a key one - there is a reason why I've talked about Nintendo pushing female led teams to new heights and how this differs from many of the competition. It's one thing to have a female lead in your game and an entirely different thing for the team making the game to be of equal gender split and the main decision maker to be a woman. This is something many Western studios are decades away from, while Nintendo has been making a push towards this for well over a decade in certain franchises.

Secondly in terms of work/life balance within Nintendo employees especially in Japan, its well known that most seem happy and spent decades in the company. This builds a positive brand image that further elevates them to future game makers beyond the franchises they make - which is generally what attracts employees to a company.

They are also the one gaming company that has outright said they don't have any forced labor within their supply chain, something neither Sony nor Microsoft have outright said in their IR meetings

Nintendo denies claims of forced labour in supply chain

Nintendo has denied allegations of forced labour found inside factories that manufacture its products. The allegations …

When we look at the governance factors, here is where we talk about things like Executive Pay(like Iwata famously taking a pay cut and in general there not being such a huge gap between workers and executives compared to Western counter parts), Business ethics those are all very good the one area where Nintendo could probably improve is Board and Executive diversity but they've been making steps in this direction https://www.alliancetrust.co.uk/news-items/news/nintendo/

Finally and this to me it's the most important factor is sustainability, outside of very few games Nintendo has a sustainable gaming pipeline that won't be hurt by one or two games under performing. Most of their gaming budgets are far smaller compared to competitors in the space and this means that the business is going to continue to see sustainable growth in all likelyhood. For every game that under-performs there are examples of titles that surpass expectations. Compare that to companies of similar size in the gaming business that take a huge hit whenever one of their few titles per year doesn't reach their internal forecasts. It's far easier to predict the final result and the actual growth. For example it's pretty clear that this FY will be their Software Peak on the Switch if they manage to launch Breath of the Wild sequel before the end of March, it's actually likely going to be their best FY regardless if BotW sequel launches.

Also they are pretty much the only major game maker that has done it's best not to force gambling into games(outside of a handful of their mobile games). Sooner or later judgement day will come from a regulatory stand point around this topic and the cash cows of many of the biggest competitors will be hit hard. This has already happened with China where after companies didn't self regulate Government stepped in and took draconian measures.

When we get data from Nintendo it's actually the most data we receive from any of the hardware makers, do we know if Gamepass is profitable? Do we know how much Software PS5 is actually selling - Sony and Microsoft simply don't provide the same amount of data for an investor to be able to really get a good grasp on what to expect when the financial results come out. In fact in some cases Sony and Microsoft do their best to make it difficult for investors unless they have access to paid analysts or market research companies that have access to more data than the regular retail investor.

Last edited:

The stock split hasn't even happened yet lol, it starts on October 1st this year. Anyway they snapping up a 5% stake has nothing to do with the stock split.Currently they remain very undervalued but their stock split is likely going to change this and is likely one of the reasons Saudi Arabia was able to snap up 5% all of the sudden

Before the stock split the minimum entry to invest in Nintendo TSE was around $40000, after the stock split the minimum would be around $4000 then. So that's good for the common people but not for someone who has 500 billion dollars. It doesn't matter to them at all.

LOL are you even a Nintendo fan? Why would you do that. Investors keep the company alive not to mention Nintendo themselves is the biggest investor of Nintendo. The biggest priority for Nintendo is to make its investors happy.good to make investors unhappy

Anyway we all look for different things as investors. Some look for double digits growth which Nintendo didn't do(and their forecast is down next year again). I personally am okay with that as their PE is low, but I want Nintendo to use their cash to buy out gaming studios which they aren't so I'm not really happy with that. But their stocks doing well currently so I'm happy for now.

Lol, do what? I don't think posts on an internet forum are going to affect Nintendo or their investors. Also, no offense, but I doubt your investment is of a size that even makes the article relavent to you.The stock split hasn't even happened yet lol, it starts on October 1st this year. Anyway they snapping up a 5% stake has nothing to do with the stock split.

Before the stock split the minimum entry to invest in Nintendo TSE was around $40000, after the stock split the minimum would be around $4000 then. So that's good for the common people but not for someone who has 500 billion dollars. It doesn't matter to them at all.

LOL are you even a Nintendo fan? Why would you do that. Investors keep the company alive not to mention Nintendo themselves is the biggest investor of Nintendo. The biggest priority for Nintendo is to make its investors happy.

Anyway we all look for different things as investors. Some look for double digits growth which Nintendo didn't do(and their forecast is down next year again). I personally am okay with that as their PE is low, but I want Nintendo to use their cash to buy out gaming studios which they aren't so I'm not really happy with that. But their stocks doing well currently so I'm happy for now.

To clarify my question - Why would a fan of the company want the investors unhappy? It makes no sense.Lol, do what? I don't think posts on an internet forum are going to affect Nintendo or their investors. Also, no offense, but I doubt your investment is of a size that even makes the article relavent to you.

No idea, Aostia82 would have to answer that. I'm guessing it's some kind of anti capitalist viewpoint.To clarify my question - Why would a fan of the company want the investors unhappy? It makes no sense.

The stock split hasn't even happened yet lol, it starts on October 1st this year. Anyway they snapping up a 5% stake has nothing to do with the stock split.

Before the stock split the minimum entry to invest in Nintendo TSE was around $40000, after the stock split the minimum would be around $4000 then. So that's good for the common people but not for someone who has 500 billion dollars. It doesn't matter to them at all.

Stock split makes it easier for retail investors to buy Nintendo which has been a major reason why it hasn't been a hot stock but rather a long one.

If you don't understand why this caused the Saudis and most likely other big investors to buy in or consider buying in right now I dont know what to tell ya

But 5% investment at the moment is certainly linked to the stock split

- Pronouns

- He/Him

I think the point @Nocturnal was making is that, by opening up the stock to retail investment, now is the ideal time to buy in, before an increase in retail investment causes a potentially higher stock value and makes it more expensive to buy in. In this regard, you may see banks and trusts and whatnot try to incrementally increase their share quantities ahead of the split.

I wouldn't consider the Saudi's retail investors because the volume they trade at vastly outstrips what any retail investor could partake in. Honestly though, going by traditional definitions I have 0 idea what umbrella they should be considered. Stock Splits benefit like me and you, I dont think the split changes anything for institutional investors outside of signaling belief in growth. I don't think retail investors will boost the stock price up that much tbh. Granted the liquidity of shares would improve for sure. I could be wrong here though. Someone with a finance background would better be able to answer.

One of the major obstacles in investing into Nintendo has been the upfront cost of investing and the risk associated with it, retail investment has changed a lot nowadays compared to where they were 5-10 years ago

I would just recommend to wait until next year and revisit this conversation

There is no way you aren't factoring the stock split into a 5B investment

I would just recommend to wait until next year and revisit this conversation

There is no way you aren't factoring the stock split into a 5B investment

Maybe they should try to make realistic projections.I dunno why people consistently look at it like this when that's not how investors review performance. There is a difference between a company being healthy and well run and a company being an exciting investment opportunity. Not saying Bloomberg is right but the suggestion is not that Nintendo is doing poorly.

Would you just take what a company says they'll do at face value and give them your money? It's more likely that institutional investors would generate their own projections.

Maybe they should try to make realistic projections.

What's a realistic projection? Like sometimes I really dunno what you guys are arguing when you never pin any real numbers to your criticism. The current stock valuation would already factor in these financial results. Unless you believe the stock is highly undervalued (which is valid if you have a model or at least rationale to suggest why you think the share price should be higher) you're literally not saying anything.

- Pronouns

- He/Him

It’s rather commonly discussed that Nintendo is considered an undervalued stock by people who follow this stuff professionally, primarily because investment has been weaker ever since the Wii/DS boom and bust of its share price and those who can afford the stock (and aren’t well-versed in the industry) worry about a sudden drop in value as it’s been steadily climbing during the Switch years. The $5b stock buy is betting that won’t happen with an increase in the investor pool once the stock split makes Nintendo stock more accessible to retail investors and encourages a different class of buyers who are more bullish and less risk-averse (but more volatile, meaning more ups-and-downs in the price). There are some who think that won’t ultimately matter, though, as they think the semiconductor shortage will continue to depress demand for stock in companies that sell electronics.What's a realistic projection? Like sometimes I really dunno what you guys are arguing when you never pin any real numbers to your criticism. The current stock valuation would already factor in these financial results. Unless you believe the stock is highly undervalued (which is valid if you have a model or at least rationale to suggest why you think the share price should be higher) you're literally not saying anything.

Mmm, yes. Delicious.

- Pronouns

- He/Him

Europe took a nosedive this quarter and was outsold by ROW/other, perhaps overshipping in Q3. The America's carried Switch this quarter which is surprising because the NPD results didn't seem that great and the US typically accounts for 80%+ sales for the region. Either undershipping in Q3 or South American countries got decent shipments.

Last edited:

I think that both the US and Europe data were related to supply dynamics.Sales in millions

Europe took a nosedive this quarter and was outsold by ROW/other, perhaps overshipping in Q3. The America's carried Switch this quarter which is surprising because the NPD results didn't seem that great and the US typically accounts for 80%+ sales for the region. Either undershipping in Q3 or South American countries got decent shipments.

Nintendo was able to exceed demand in Europe during the holiday quarter because it was easier to ship units there. They were held back in American supply and had to resort to air shipping in December. This led to the terrible NPD result for Switch in January - the air shipments were gone and the resumed shipments by sea hadn’t gotten there yet. Nintendo was able to ship units again to America in Feb and March, and retailers were able to restock enough to have some units on shelves (Except OLED.)

- Pronouns

- He/Him

Wasn't one of the questions in the Q&A about how Nintendo plans to ship it's hardware to Europe with the ongoing war in Ukraine and they acknowledged it's an issue?Sales in millions

Europe took a nosedive this quarter and was outsold by ROW/other, perhaps overshipping in Q3. The America's carried Switch this quarter which is surprising because the NPD results didn't seem that great and the US typically accounts for 80%+ sales for the region. Either undershipping in Q3 or South American countries got decent shipments.

I'm thinking "Hold" but am also ready to "Sell", depending.I guess the question to ask is if you have Nintendo stock is would you buy, sell or hold based on these results?

These results, projections and subsequent announcements encourage me to hold on til at least the split.

Immediate positive factors include a) highly profitable mature business that will see solid growth in earnings (at a slower rate), b) IP-growth initiatives w/ movies and theme-parks will reach market and I expect further projects to be announced, c) The Successor announcement looms.

Immediate negative factors include a) clearly on the down-phase of current product life cycle; I would not be surprised if they do not hit their 21 million unit target this FY, b) their other growth initiatives have floundered (mobile) or are nascent (leveraging their IP in other industries), c) Opportunity-cost of putting money in other places.

Tbh, mostly I hold til now just because I am a Fan, and with some portion of investments I just bought what I like and respect. I'll hold longer, like maybe 6 months to a year and reassess, based on the above points and the stock-split news.

- Pronouns

- he/him

Newish old info. Nintendo has been reporting separate numbers for the original Switch model since Lite released, but they never did that for the original models of GBA, DS, or 3DS. As a result, those numbers also weren't in the Garaph database for making simple comparisons. But over the last few days I derived them from the other known values. Like GBA Original = GBA Total - GBASP - GB Micro. This results in values that wobble a bit if you try to look too closely at the values, but it's fine for a line. In this short Twitter thread I show comparisons of the models for each generation, among the WW/JP/NA/EU regions.

Nintendo = Profits for me lol. That’s what I look at. Investor expectations are important, but at the end of the day Nintendo leads in the areas ( hardware sales & 1st party software sales) that are going to ensure they stay comfortably sustainable as they branch out into more growth opportunities.

- Pronouns

- He/Him

Q1 Earnings report scheduled for the 3rd of August https://www.nintendo.co.jp/ir/en/schedule/index.html.

I'm expecting a small hardware decline from the 4.45 million sold last year. For a rough guide we know 840K were sold in Japan in FYQ1 and Japan so far represents 23.4% of Switch hardware sales which is 1/4.27 so 4.27 x 840K = 3.58 million. However i expect a little bit more because Japan seems to be declining slightly more compared to other major regions because of it's smaller population which means saturation is more of a factor. I predict 3.75 to 3.9 million for the quarter.

I'm expecting a small hardware decline from the 4.45 million sold last year. For a rough guide we know 840K were sold in Japan in FYQ1 and Japan so far represents 23.4% of Switch hardware sales which is 1/4.27 so 4.27 x 840K = 3.58 million. However i expect a little bit more because Japan seems to be declining slightly more compared to other major regions because of it's smaller population which means saturation is more of a factor. I predict 3.75 to 3.9 million for the quarter.

Last edited:

- Pronouns

- He

That's pretty good Luminoth, my fellow prime 2 fan. Still, I'm a 2D Metroid fan first but that's for another conversation.

You're right that Japan seems to be declining more than other regions but I still kinda expect a harsher decline from either the US or Europe just for this period. So I'll predict 3.6M.

PS: Prime 2 is more fun and cooler than 1

You're right that Japan seems to be declining more than other regions but I still kinda expect a harsher decline from either the US or Europe just for this period. So I'll predict 3.6M.

PS: Prime 2 is more fun and cooler than 1

For anyone that was saying Switch would need to outsell NDS + Wii combined in order to be a success since it consolidates home and handheld console into one, this chart proves otherwise.Yearly net profit

Last edited:

For anyone that was saying Switch would need to outsell NDS + Wii combined in order to be a success since it consolidates home and handheld console into one, this chart proves otherwise.

Those complain is always troll lol. Thats like saying PS4+Vita need to outsell PS3+PSP to be successful.

The gaming world has changed. Company now can get more money from more avenue than Wii era.

- Pronouns

- He/Him

Prime 2 is the darkest most atmospheric game in the original trilogy and that's why it's my favourite.That's pretty good Luminoth, my fellow prime 2 fan. Still, I'm a 2D Metroid fan first but that's for another conversation.

You're right that Japan seems to be declining more than other regions but I still kinda expect a harsher decline from either the US or Europe just for this period. So I'll predict 3.6M.

PS: Prime 2 is more fun and cooler than 1

Last edited: