- Pronouns

- He/Him

- Thread starter

- #1

https://www.capcom.co.jp/ir/english/news/html/e230130b.html

Sources

Financial Results - https://www.capcom.co.jp/ir/english/data/pdf/result/2022/3rd/result_2022_3rd_01.pdf

Financial Results Presentation - https://www.capcom.co.jp/ir/english/data/pdf/explanation/2022/3rd/explanation_2022_3rd_01.pdf

Previous threads

FY3/2023

Q1 - https://www.installbaseforum.com/forums/threads/capcom-q1-fy3-2023-financial-results.947/

Q2 - https://www.installbaseforum.com/forums/threads/capcom-q2-fy3-2023-financial-results.1139/

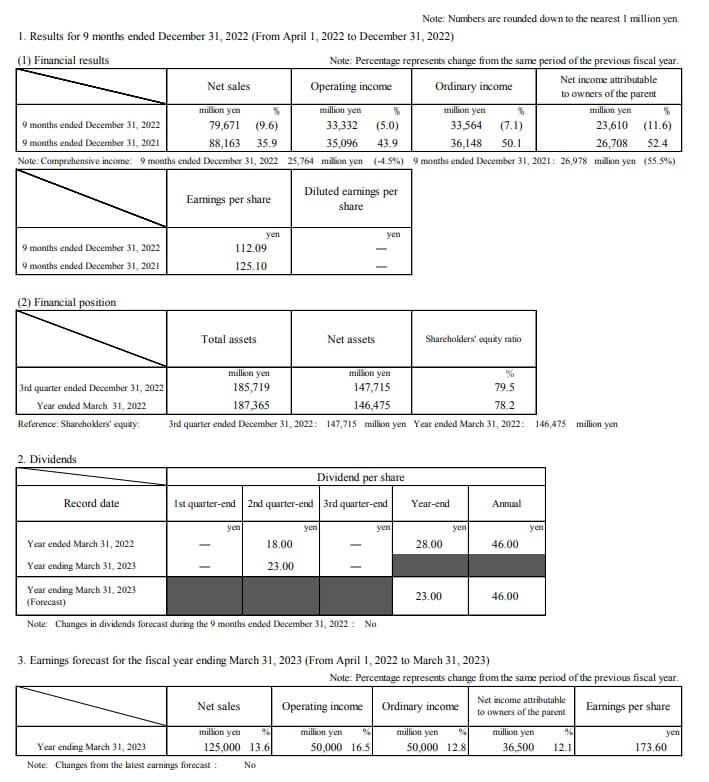

Capcom Co., Ltd. today announced that in its consolidated business results for the nine months ended December 31, 2022, net sales were 79,671 million yen (down 9.6% year-over-year), operating income was 33,332 million yen (down 5.0% year-over-year), ordinary income was 33,564 million yen (down 7.1% year-over-year), and net income attributable to owners of the parent was 23,610 million yen (down 11.6% year-over-year).

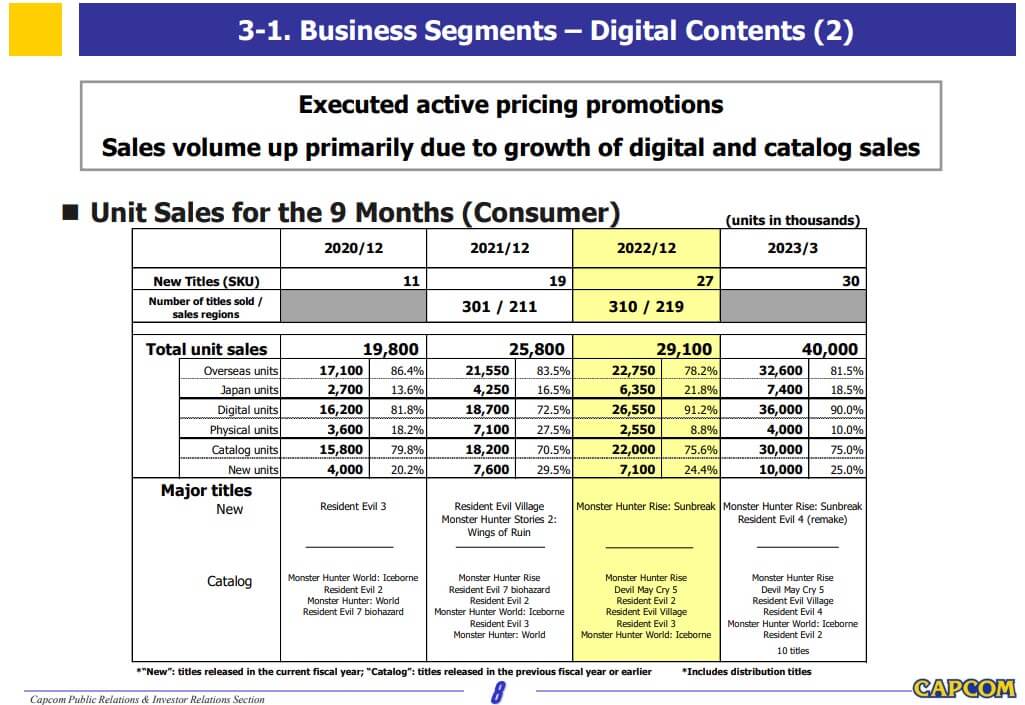

At the end of the nine months ended December 31, 2022, Capcom’s core Digital Contents business delivered sales of 29.1 million units for its home video game software, marking a year-over-year increase. The company achieved this with the release of Monster Hunter Rise: Sunbreak, the major new title in its flagship series, as well as through its ongoing pursuit of digital sales, including sales of catalog titles composed primarily of entries in major series, such as Monster Hunter Rise. While a new major title in the same period of the previous year created a comparative decline in sales and profit year-over-year, Capcom is on track to achieve its expected full-year earnings and will focus on the upcoming major title release in the fourth quarter of the fiscal year as well as on the continued promotion of catalog title sales.

The forecast for the consolidated business results for the current fiscal year ending March 31, 2023, remains the same as what was announced on October 26, 2022.

Sources

Financial Results - https://www.capcom.co.jp/ir/english/data/pdf/result/2022/3rd/result_2022_3rd_01.pdf

Financial Results Presentation - https://www.capcom.co.jp/ir/english/data/pdf/explanation/2022/3rd/explanation_2022_3rd_01.pdf

Previous threads

FY3/2023

Q1 - https://www.installbaseforum.com/forums/threads/capcom-q1-fy3-2023-financial-results.947/

Q2 - https://www.installbaseforum.com/forums/threads/capcom-q2-fy3-2023-financial-results.1139/

Last edited:

Once more, the following comes from my webpage: https://r134x7.github.io/nintendo-earnings-data-and-other-video-game-companies/#/capcom

Consolidated Financial Results:

Consolidated Financial Results:

Code:

+−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Capcom | FY3/2023 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Segment Information |

+−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Digital Contents - Package & Digital |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥19,200M | 11.7M | ¥1,641 |

| YoY% | -55.35% | -12.03% | -49.24% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥15,700M | 9.6M | ¥1,635 |

| YoY% | +6.08% | +47.69% | -28.19% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥24,300M | 7.8M | ¥3,115 |

| YoY% | +153.12% | +30% | +94.69% |

+==================================================+

| First Half | ¥34,900M | 21.3M | ¥1,638 |

| YoY% | -39.62% | +7.58% | -43.88% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3 Qtrs | ¥59,200M | 29.1M | ¥2,034 |

| YoY% | -12.17% | +12.79% | -22.13% |

+==================================================+

| *Sales includes: - Downloadable content |

| purchases |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Digital Contents - Package & Digital |

| Forecast |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

|FY3/2023 Forecast| ¥91,400M | 37M | ¥2,470 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| FCST Revision 1 | ¥95,100M | 40M | ¥2,378 |

+======================================================+

| *Sales includes: - Downloadable content |

| purchases |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Package |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥2,900M | 1.3M | ¥2,231 |

| YoY% | -84.24% | -69.05% | -49.08% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥1,400M | 0.5M | ¥2,800 |

| YoY% | -71.43% | -70.59% | -2.85% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥5,900M | 0.75M | ¥7,867 |

| YoY% | +156.52% | -37.5% | +310.38% |

+==================================================+

| First Half | ¥4,300M | 1.8M | ¥2,389 |

| YoY% | -81.55% | -69.49% | -39.5% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3 Qtrs | ¥10,200M | 2.55M | ¥4,000 |

| YoY% | -60.16% | -64.08% | +10.93% |

+==================================================+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Package Forecast |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

|FY3/2023 Forecast| ¥18,000M | 4.5M | ¥4,000 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| FCST Revision 1 | ¥16,300M | 4M | ¥4,075 |

+======================================================+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Digital |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st Quarter | ¥16,300M | 10.4M | ¥1,567 |

| YoY% | -33.74% | +14.29% | -42.03% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 2nd Quarter | ¥14,300M | 9.1M | ¥1,571 |

| YoY% | +44.44% | +89.58% | -23.81% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 3rd Quarter | ¥18,400M | 7.05M | ¥2,610 |

| YoY% | +152.05% | +46.88% | +71.6% |

+==================================================+

| First Half | ¥30,600M | 19.5M | ¥1,569 |

| YoY% | -11.3% | +40.29% | -36.78% |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| 1st 3 Qtrs | ¥49,000M | 26.55M | ¥1,846 |

| YoY% | +17.22% | +41.98% | -17.4% |

+==================================================+

| *Sales includes: - Downloadable content |

| purchases |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| Digital Forecast |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| | | | Sales Per |

| | | Software | Software |

| | Sales | Units | Unit |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

|FY3/2023 Forecast| ¥73,400M | 32.5M | ¥2,258 |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

| FCST Revision 1 | ¥78,800M | 36M | ¥2,189 |

+======================================================+

| *Sales includes: - Downloadable content |

| purchases |

+−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−−+

Last edited:

Presentation Slides are up

https://www.capcom.co.jp/ir/english/data/html/explanation/2023/3rd/2.html

https://www.capcom.co.jp/ir/english/data/html/explanation/2023/3rd/2.html

Pretty good numbers imo. Sure, there's a top-line decline, but that's with a relatively small slate of new releases and on the back of 35% revenue growth last year, while increasing operating margins.

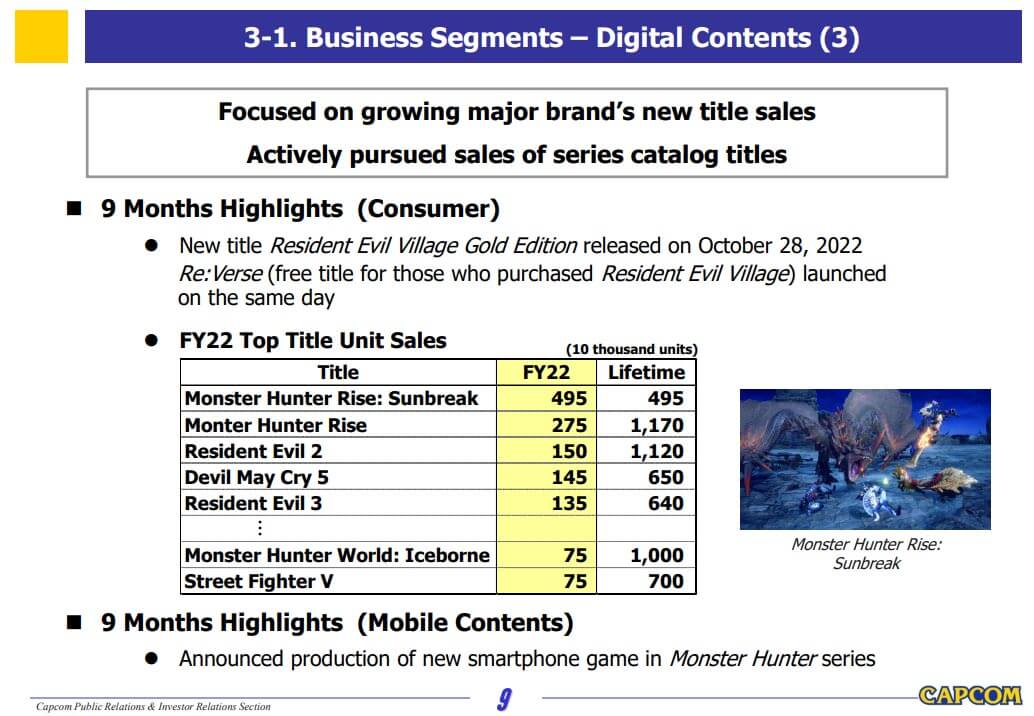

Monster Hunter Rise Sunbreak sold another 450k copies during the quarter, which is steady.

Overall Capcom seems well positioned.

Monster Hunter Rise Sunbreak sold another 450k copies during the quarter, which is steady.

Overall Capcom seems well positioned.

@Oscar in the graphs the "Game sold (shipment+digital, million unit)" should be 29.1 instead of N/A.

The reason it said N/A is most likely because we had to wait for the slides to appear with that data.

We’ll positioned the right phrase. They will have RE4 and SF6 this year at least whilst their legacy titles continue to sell well.Pretty good numbers imo. Sure, there's a top-line decline, but that's with a relatively small slate of new releases and on the back of 35% revenue growth last year, while increasing operating margins.

Monster Hunter Rise Sunbreak sold another 450k copies during the quarter, which is steady.

Overall Capcom seems well positioned.

RE2 is a beast , 1.5M in 9 months including 1M in Q3 , At very low Prices currently of course but still

There is potential for it to surpass RE7 in Q4 depending on what RE7 did in Q3 , RE7 as of Q2 was 11.3M , and IMO RE4 Effect will be stronger on RE2 than RE7 in Q4

Capcom is in such a good shape, the financials show clear and steady growth.

They mastered their promotional strategy too, their games dropping in price don't affect launch sales like it does at Ubisoft.

In the current quarter, Resident Evil 4 Remake should be huge and close a great FY for them.

They mastered their promotional strategy too, their games dropping in price don't affect launch sales like it does at Ubisoft.

In the current quarter, Resident Evil 4 Remake should be huge and close a great FY for them.

Last edited:

I really hope RE4 on PC launches in a good state. I would love to dive back in this world on Day 1.

I wonder if a cloud version will eventually launch on Switch.

I have a feeling the developers are really squeezing themselves in order to release it before the end of the Fiscal Year , so hopefully a botched PC Release like Village isn't one of the compromises for that , No Xbox One release could be one of the compromises if it isn't tied to a deal with Sony

Capcom is in such a good shape, the financials show clear and steady decline.

That looks like a typo

Big numbers to come for RE4R since they're expecting their best Q4 ever and that's up to the game to do the heavy lifting there.

I think a big part of that is how successfully they’ve translated a lot of their titles to PC.I'm surprised nobody else manages to leverage their catalog like Capcom does. If something can make AAA development sustainable it's this: making desirable products that can be sold for a long time through discounts

Listed Games increasing from Q2 to Q3

Resident Evil 2 : 1M

Resident Evil 3 : 800K

MH Rise : Sunbreak : 550K

Monster Hunter Rise : 500K

Devil May Cry 5 : 400K

Monster Hunter World: Iceborne : 300K

Street Fighter V : 200K

Most Japanese publishers are leveraging their back catalog. I'm pretty sure it's the whole reason for the Encore line from Bandai Namco. It's just the quality thing and genre that hinders this level of sales. Also EGS exclusives seem to never recover from not being on Steam for Square Enix.I'm surprised nobody else manages to leverage their catalog like Capcom does. If something can make AAA development sustainable it's this: making desirable products that can be sold for a long time through discounts

Some of those games are marred by being middling ports. FF7 being a notable oneMost Japanese publishers are leveraging their back catalog. I'm pretty sure it's the whole reason for the Encore line from Bandai Namco. It's just the quality thing and genre that hinders this level of sales. Also EGS exclusives seem to never recover from not being on Steam for Square Enix.

Yes, I remember their goal, some years ago, to eventually have Steam make 50% of their revenueI think a big part of that is how successfully they’ve translated a lot of their titles to PC.

Aside from that, Square Enix ports are generally of low quality (the last notable one being Strangers of Paradise) and they don't seem to have one, coherent strategy neither for what games to port and remaster nor for discounts (look at resident evil and monster hunter prices during sales).Most Japanese publishers are leveraging their back catalog. I'm pretty sure it's the whole reason for the Encore line from Bandai Namco. It's just the quality thing and genre that hinders this level of sales. Also EGS exclusives seem to never recover from not being on Steam for Square Enix.

If Bandai Namco cared we'd have more than one Ace Combat game available on Steam. It's exactly the type of series Resident Evil is, after all: a series where every chapter is distinct and where you can sell older chapters at lower prices to people who get in through the latest. The only other japanese publisher that comes close is Sega, but it's something way more recent (and they make lower budget games with lower expectations)

Ace Combat is licensing issues and honestly is only alike with RE in cheesy story. Flight sims like Ace Combat do not sell like a Survival Horror game though I believe they could sell like DMC. You are also missing the fact that all their relevant anime games go on sales every other month and resulted in the huge sales in Dragon Ball FighterZ, Xenoverse and Naruto Ultimate Ninja Storm with smaller successes from DBZ Kakarot, OP Warriors, MHA and Shinobi Striker. Tekken is showing a similar curve as Street Fighter as well. Their other regularly discounted games are RPGs which have a much shorter ceiling than a Resident Evil.Yes, I remember their goal, some years ago, to eventually have Steam make 50% of their revenue

Aside from that, Square Enix ports are generally of low quality (the last notable one being Strangers of Paradise) and they don't seem to have one, coherent strategy neither for what games to port and remaster nor for discounts (look at resident evil and monster hunter prices during sales).

If Bandai Namco cared we'd have more than one Ace Combat game available on Steam. It's exactly the type of series Resident Evil is, after all: a series where every chapter is distinct and where you can sell older chapters at lower prices to people who get in through the latest. The only other japanese publisher that comes close is Sega, but it's something way more recent (and they make lower budget games with lower expectations)

Resident Evil's legs feel like they come from a similar place as a long running horror movie franchise like Halloween. I suspect Dead Space will have similar legs as one of the few franchises that achieve the same kind of feeling.

- Pronouns

- He/Him

These Resident evil games selling millions multiple years after release is impressive, is it down to price drops, word of mouth or both? They are also streamed alot during halloween so that could help push sales too.

These Resident evil games selling millions multiple years after release is impressive, is it down to price drops, word of mouth or both? They are also streamed alot during halloween so that could help push sales too.

Both. And in case with Resident Evil 2/3 remakes this FY:

Worth remembering: RE2/3 had their native PS5/XBS releases this FY and Switch Cloud releases last quarter.

Did it for Koei Tecmo so might as well do it here:

FY2022

FY2022

- 05.07.21 Resident Evil Village (PC, PS4, PS5, XBO, XBS)

- 05.25.21 Capcom Arcade Stadium (PC, PS4, XBO)

- 06.01.21 Ghosts 'n Goblins Resurrection (PC, PS4, XBO)

- 07.09.21 Monster Hunter Stories 2: Wings of Ruin (NSW, PC)

- 07.27.21 The Great Ace Attorney Chronicles (NSW, PC, PS4)

- 01.12.22 Monster Hunter Rise (PC)

- 06.13.22 Resident Evil 2 (PS5, XBS)

- 06.13.22 Resident Evil 3 (PS5, XBS)

- 06.13.22 Resident Evil 7: biohazard (PS5, XBS)

- 06.24.22 Capcom Fighting Collection (NSW, PC, PS4, XBO)

- 06.30.22 Monster Hunter Rise: Sunbreak (NSW, PC)

- 07.22.22 Capcom Arcade 2nd Stadium (NSW, PC, PS4, XBO)

- 10.28.22 Resident Evil Village - Cloud (NSW)

- 11.11.22 Resident Evil 2 - Cloud (NSW)

- 11.18.22 Resident Evil 3 - Cloud (NSW)

- 12.16.22 Resident Evil 7: biohazard - Cloud (NSW)

- 01.20.23 Monster Hunter Rise (PS4, PS5, XBO, XBS)

- 03.24.23 Resident Evil 4 (PC, PS4, PS5, XBO, XBS)

- Pronouns

- He/Him

These Resident evil games selling millions multiple years after release is impressive, is it down to price drops, word of mouth or both? They are also streamed alot during halloween so that could help push sales too.

Capcom Catalog sales are almost feeling like Nintendo games at this point albeit more discounted.

Is there any other third party publisher that has multiple series with good legs for years sometimes with several seperate entries in a series selling well simeltaneously?

Many either bank extremely heavily on launch sales or do yearly games that often will cut off the legs of the prior game.