- Pronouns

- He/Him

- Thread starter

- #1

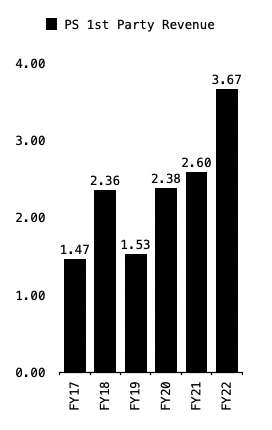

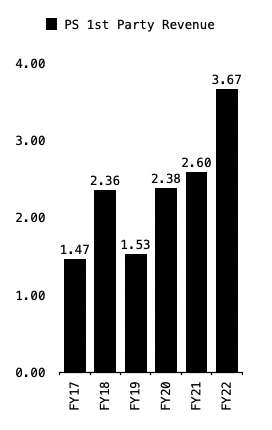

Thought I would make a dedicated thread since we finally have the data to see the revenue of Playstation 1st party over the years and maybe even their profitability.

From the FY presentation:

We got data from the ATVI case on PS Studios FY21 revenue on console:

www.installbaseforum.com

www.installbaseforum.com

And we got a graph on the growth of PS 1st party sales and costs in a prior FY report:

So we can now estimate the revenue via pixel counting. Its not perfect since its CY vs FY iirc:

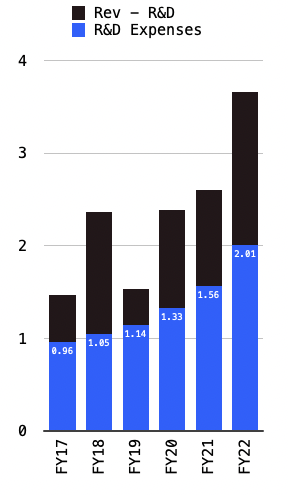

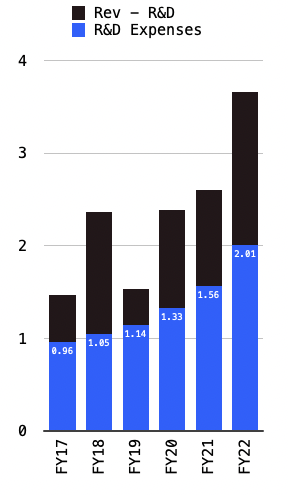

Sony also discloses R&D costs per year so we can do a somewhat crude comparison on profitability over the years as well.

There was much prior discussion if the strategy of $70 would work out. The big games are doing better than ever. Total unit sales for the year are down and yet revenue being so up shows the strategy work.

All this and there is still growth to be had. Franchises are still breaking records, new IPs are coming up, we will start to see the beginning of Sony's GaaS initiative soon, acquisitions made prior have yet to release a title, there is the PC/mobile expansion and there are future potential acquisitions.

Worth noting how Sony had constantly mentioned rising dev costs as well. The idea of dev costs stabilising, whether its from AAA talent being very sought after now, or other economic factors, is not one I expect this gen. The Sony transcript shows clear intention to accomodate increased dev costs and keep margin low as a result. Also due to continued acquisition costs.

Really curous what PS studios looks like 5Y down the line and how much higher it can go.

From the FY presentation:

We got data from the ATVI case on PS Studios FY21 revenue on console:

Sony is 4th largest publisher, ~ equivalent to ATVI, in 2021 global console publishing (revenue), nearly double the size of Xbox+Bethesda

We've got enough information from the recent MS filing to tabulate the rankings of game publishers. I am assuming revenue is the metric here, as if it was unit sales Epic would not be so high and the graph prior on Meta vs Giphy refers to revenue from what I remember. Source is FMN (?), seems to...

And we got a graph on the growth of PS 1st party sales and costs in a prior FY report:

So we can now estimate the revenue via pixel counting. Its not perfect since its CY vs FY iirc:

Sony also discloses R&D costs per year so we can do a somewhat crude comparison on profitability over the years as well.

There was much prior discussion if the strategy of $70 would work out. The big games are doing better than ever. Total unit sales for the year are down and yet revenue being so up shows the strategy work.

All this and there is still growth to be had. Franchises are still breaking records, new IPs are coming up, we will start to see the beginning of Sony's GaaS initiative soon, acquisitions made prior have yet to release a title, there is the PC/mobile expansion and there are future potential acquisitions.

Worth noting how Sony had constantly mentioned rising dev costs as well. The idea of dev costs stabilising, whether its from AAA talent being very sought after now, or other economic factors, is not one I expect this gen. The Sony transcript shows clear intention to accomodate increased dev costs and keep margin low as a result. Also due to continued acquisition costs.

Really curous what PS studios looks like 5Y down the line and how much higher it can go.